Crypto Whales are the largest holders of cryptocurrencies, which can have millions of coins in their account. Who are they and how do their savings affect the rate of cryptocurrencies?

Who are crypto whales and what are they

A whale is a holder of a large number of cryptocurrencies. But there is no certain amount with which it would be possible to definitely call this or that crypto-investor a whale. The members of the crypto community themselves distinguish 2 subspecies of “whales” – simple and “humpbacked”. An ordinary whale is usually called an investor who has from one to five thousand bitcoins in his account. The “humpbacked” category, respectively, includes market participants who have more than 5,000 BTC.

In February 2021, GlassNode analysts provided a rough ranking of whales. And humpbacked ones are far from the only ones in this aquarium. In the crypto community, there were definitions for other categories of large investors. According to the authors of the study, it is the whales that play the leading role in the crypto industry. They are followed by sharks, dolphins, and shrimp account for the least amount of bitcoins. There are eight groups in total:

- Humpback whale (more than 5000 BTC)

- Whale (1000-5000 BTC)

- Shark (500-1000 BTC)

- Dolphin (100-500 BTC)

- Fish (50-100 BTC)

- Octopus (10-50 BTC)

- Crab (1-10 BTC)

- Shrimp (less than 1 BTC)

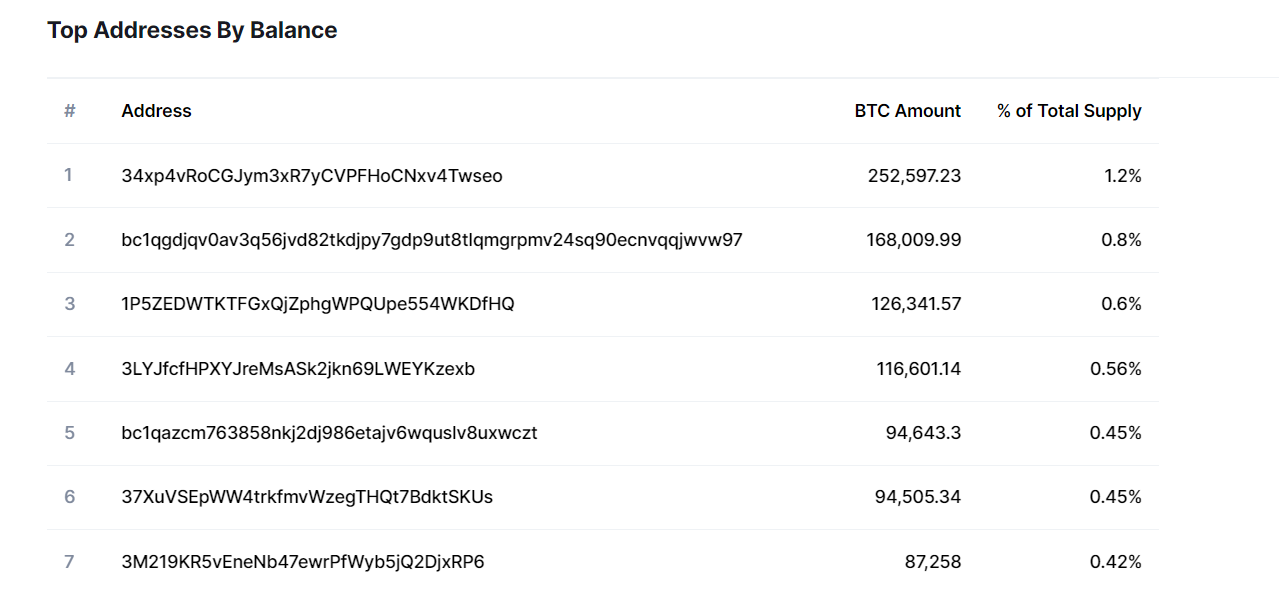

All major tokens have addresses that hold a huge amount of funds – not only Bitcoin. At the same time, through the blockchain and special services, it is always relatively easy to check who is the top hodler (holder) of a particular cryptocurrency. For example, by going to Coinmarketcap and going down to Top Addresses By Balance, anyone can see not only the address of the wallet and the amount of bitcoin in it, but also the percentage of the total supply of the asset (if it is limited at all).

Сrypto whales definition

In other words, the answer to the question of who are the whales in the cryptocurrency market can be formulated as follows – these are those who occupy the first positions in the asset retention in the rating.

Who has the most bitcoins

It is not always the case that the top address is also the largest holder of an asset. Cryptocurrency can be owned by various companies, holdings, corporations, or just a group of very wealthy individuals who buy up an asset and store it on different wallets. Thus, for example, there may not be so many bitcoins on one separate wallet of MicroStrategy, although in fact it is one of its largest hodlers.

Let’s figure out who has the most bitcoins from its largest holders.

Whale #1: Satoshi Nakamoto

In the first place is the mysterious and enigmatic creator of Bitcoin Satoshi Nakamoto. According to various estimates, up to 1.1 million bitcoins can be on his account – this is about 5% of the total supply of this cryptocurrency. If desired, Satoshi could greatly influence the price of bitcoin. However, no one knows who he really was – and whether he is alive now, if he ever existed at all.

Whale #2: Binance

The cold wallets of the most popular and largest exchange, Binance, have about 265,000 BTC. This is really an impressive amount, and at the moment it is believed that there are no more bitcoins in one address than here.

Whale #3: Bulgaria

The record holder of the international race is Bulgaria, which has about 213 thousand bitcoins at its disposal. They got to the government of the country after they were seized during a special operation to capture a dangerous criminal group. On her accounts, they found such a colossal amount of bitcoins. However, so far Bulgaria has stubbornly not talked about its future intentions regarding this cryptocurrency.

Whale #4: Bitfinex

The BitFinex exchange holds 168k BTC in its cold wallet, not as impressive as Binance, but still.

Whale #5: MicroStrategy

MicroStrategy, which is the largest bitcoin holder among public global corporations, boasts a net worth of 124,000 BTC. They constantly buy a certain amount of bitcoin – both on the fall and on the rise. Their average purchase price of a crypto asset at the moment is about $49,000.

What are the pros and cons of crypto whales

The biggest danger that the whales of any cryptocurrency can pose is the impact on its value. Whales of different cryptocurrencies usually hide themselves and act as anonymous. After all, cryptocurrencies, blockchain and bitcoin are all first of all a decentralized world. It seems that not a single person or group of persons in it can in any way affect the value of assets, this is the beauty of decentralization. But whales, due to their size, can still upset this balance.

The actions of whales can often lead to various fluctuations in the crypto market. The recent collapse in the price of bitcoin to $ 30 thousand occurred against the background of the fact that a rumor spread on the social network Twitter about the allegedly massive sale of digital coins by Tesla. Later, the CEO of Tesla, billionaire Elon Musk, denied this information. He stated that the company has not sold a single digital coin since March of this year, when it recorded a profit in cryptocurrency of $101 million.

Large holders of cryptocurrencies are usually asset managers and investors who are active in traditional markets, have solid investment experience, and also have a keen understanding of market trends. Therefore, if the whales suddenly sell their assets, then this is a signal to the rest of the market participants that the rate is expected to fall.

Do I need to monitor the actions of crypto whales

For most people, the answer is a resounding no. Ultimately, it is in the whales’ interest to keep the value of their coins high, unless for some reason they plan to exit the market entirely. If you try to catch every wave they create, you will waste a lot of time.

The best long-term strategy is to keep an eye on the market as a whole and understand why things are happening the way they are. Only in this case, you can not only detect most of the manipulations by cryptocurrency whales in a timely manner, but also successfully avoid them.

In long-term investing, just knowing when you plan to exit the market, or the minimum profit you want to make (and, of course, scrupulously following this plan) will save you from rash decisions and the losses associated with them. When trading cryptocurrencies in the short term, it is also worth setting a stop loss to secure your funds.

FAQ

Who are crypto whales?

Whales are the holders of the largest amount of bitcoin or any other cryptocurrency. For bitcoin, the threshold is generally considered to be 1,000 units, and owners of more than 5,000 BTC are considered the largest holders.

What are the most famous crypto whales?

Whales can be both people and organizations. For example, the world top 3 looks like this: the mysterious Satoshi Nakamoto (presumably the Japanese who invented bitcoin), the Bitfinex exchange, the Bulgarian authorities.

Why do so many whale watching?

As in any market, the largest players can influence the market as a whole by their actions. If one or even more whales at once, for example, began to sell off cryptocurrency, it means that either they know about something that may soon drop the rate, or, even if nothing of the kind is expected, such a massive sale can lower the rate by itself.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

Join my telegram channel.

All crypto articles are here.

Reviews: