Reasonable Investor part 6

Every monday I publish excerpts from Benjamin Graham’s book The Wise Investor.

After reading the first edition of The Intelligent Investor in 1950, young American entrepreneur Warren Buffett considered this work by Benjamin Graham to be the best that has ever been written about investment. Years later, having become one of the largest investors in the world with a fortune of $ 66 billion, Buffett has not changed his mind.

A method of partial protection against inflation.

Nowadays, as in the past, the topic of inflation and methods of combating it remains quite relevant. The bondholders are suffering from inflation. First of all, inflation eats up both the interest income and the par value of bonds received at maturity.

At the same time, for shareholders, inflation is offset to some extent by rising dividends and share prices. But this does not make even the most reliable stocks a preferred investment instrument under any circumstances.

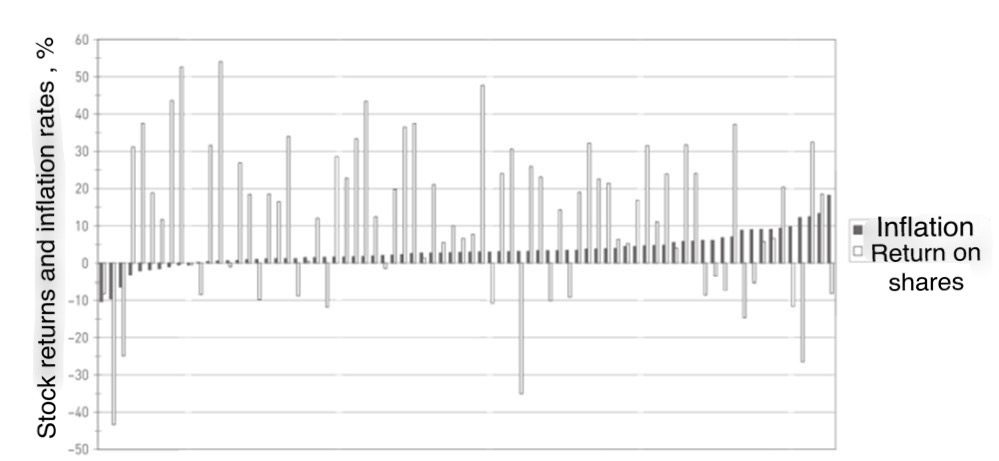

The graph below shows data from 1926 to 2002, which reflects the ratio of inflation to stock returns over this period 👇

The data on the graph is arranged from the lowest inflation to the highest, not in chronological order. Looking at the left side of the graph, during periods of falling prices for consumer goods and services (deflation), stock returns were also very low.

If you look at the right side of the graph, you can see that for 8 out of 14 years, when inflation grew at a rate of more than 6% per year, the stock market fell. At the same time, the average return over these 14 years was only 2.6%.

With an average rate of inflation growth throughout the entire period from 1926 to 2002. stock returns were normal. But with a sharp rise in inflation, for example, as on the right side of the graph, stock returns fell.

In the period considered in the graph, 64 five-year periods can be distinguished (from 1926 to 1930, from 1927 to 1931, from 1928 to 1932, etc.) and their analysis can be carried out.

In 50 cases out of 64, that is, 78% of the time period of growth of the stock market outstripped the growth of inflation, however, 20% of the time period of the stock provided the investor with protection from inflation.

Disclaimer: This news is not investment advice. Assess the risks yourself before making any investment decisions.

For a quick communication with me, write to the telegram.

All crypto articles are here.

Reviews: