A bear market is a period when the value of an asset is constantly declining.

What is a bear market

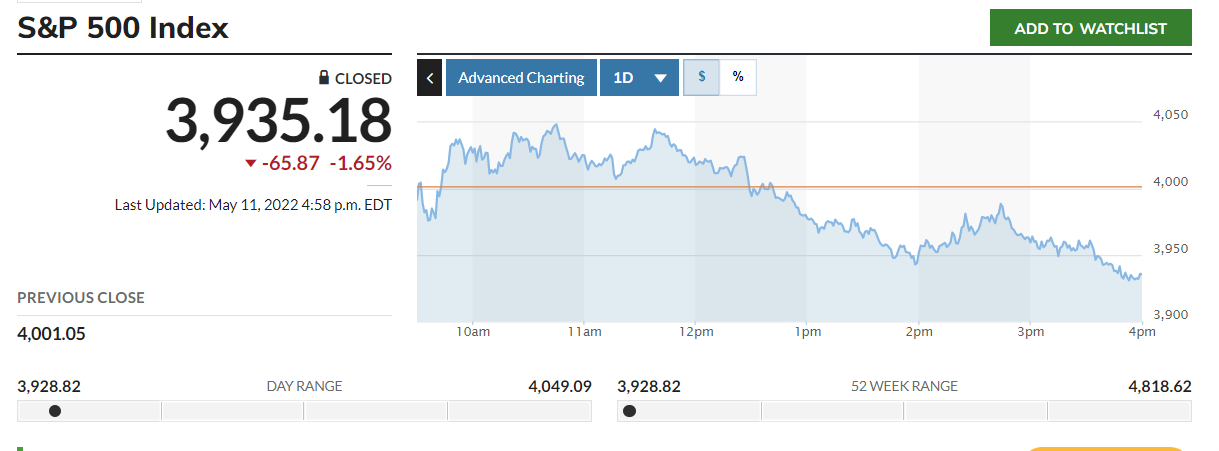

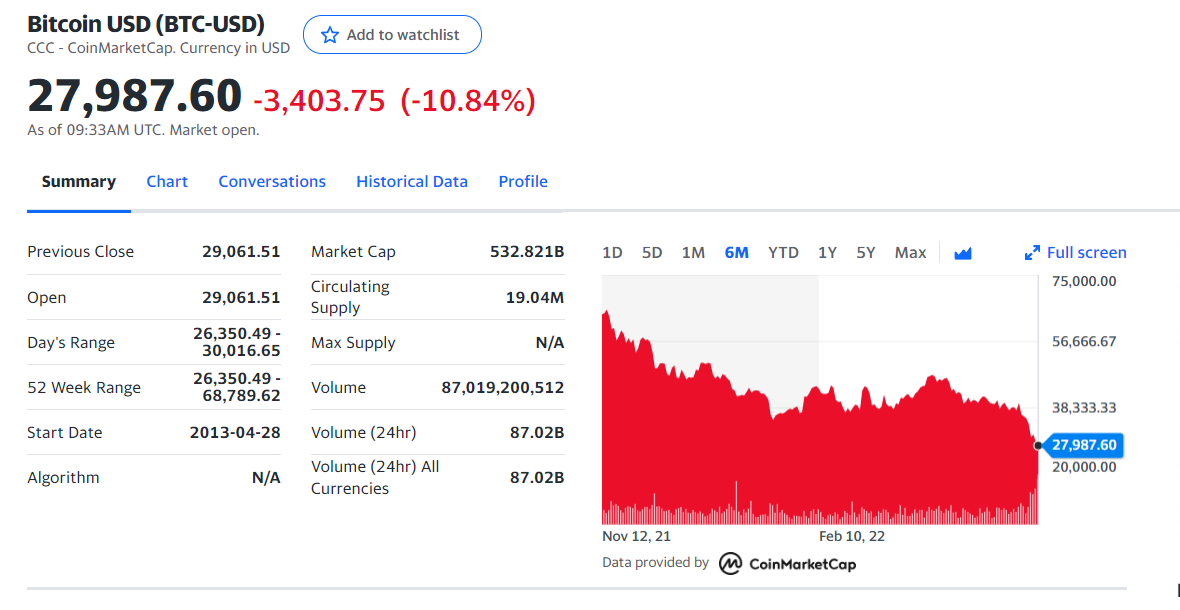

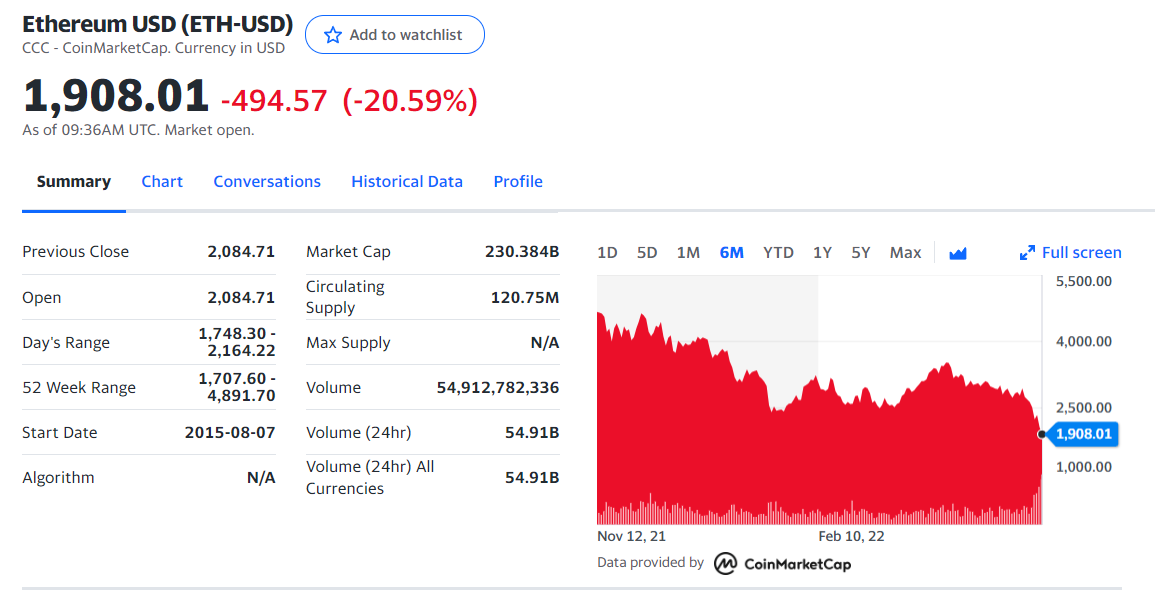

A bear market is a period when the price of an asset gradually falls. The price may recover, but in general a downtrend prevails. The price of an asset could drop 20% or more from recent highs. At this moment, the index of investors’ fear increases, panic is possible in the market. Today, you can just notice such a trend (05.12.2022)

A bearish trend is the same as a bear market and is also called a downtrend. It is opposed to a bull market.

The term bear trend is mainly associated with the stock market, but is also used in relation to the real estate market, fiat currencies and cryptocurrencies.

Take, for example, the Dow Jones Industrial Average. This is a stock market index, a measure of the value of 30 large US companies. Let’s say it closed at 26,548. If the index later drops to 21,238, then this may indicate the beginning of a bear market.

A bearish trend occurs in the face of a general downturn in the economy. For example, during the 2020 crisis due to the coronavirus pandemic, the US stock market sank by almost 34%.

A downtrend can also occur in the context of government policy. Recall the recent bans by the Chinese authorities on the crypto market, which pulled assets down.

Do not confuse a bear market with a correction. The latter implies a fall of 10-20% within a maximum of two months. That is, it is a short-term trend.

These dips are fairly common in fiat currencies and stock markets, but not every decline means that an asset is entering a bear zone. As a result of the correction, prices could fall by about 10% from recent highs. Such short-term impulses happen when the value of overvalued assets corrects to cool an overheated market.

How to trade in a bearish trend

While bear markets can test investors’ strength, even during a general downturn there can be unexpected trends. So, the shares of some companies can reverse the trend and continue to grow. Conversely, when stock markets perform well, individual company stock prices can enter a bearish zone and fall sharply, even if other corporations in the index perform well.

Unfortunately, it is impossible to understand exactly when the downtrend will begin. Based on macroeconomic indicators and the level of volatility, one can only guess whether the market is only at the beginning of a bearish trend or already in the middle.

There is no specific strategy in a bear market. If you think it will start soon, you can prepare your portfolio by diversifying it. Allocate capital between stocks, currencies, bonds and other instruments. This, of course, is not a 100% guarantee, but an opportunity to minimize risks.

What to do in a bear market

The main thing in this case is not to panic. A bear market is part of an economic cycle.

If your portfolio contains instruments that suit you in all respects before the fall, then you should not sell them during the collapse. During a bearish trend, on the contrary, they buy assets. For example, during the fall in Bitcoin prices, whales bought the first cryptocurrency for millions of dollars.

FAQ

What is a bear market?

This is a period when the price of an asset has fallen 20% or more from recent highs. At this moment, the index of investors’ fear increases, panic is possible in the market. A bearish trend is also called a downtrend. It is opposed to a bull market.

What are the basic rules for trading in a bearish trend?

The main thing is not to panic. Even during a general downturn, unexpected trends can be observed. So, the shares of some companies can reverse the trend and continue to grow. The reverse situation is also possible, it is often impossible to predict a downtrend.

How long can a bear market last?

In the US, a bear market lasts about 14 months on average. Under these conditions, the S&P 500 index, which takes into account the value of the 500 largest companies on US stock exchanges, usually loses about 33% of its value. The most notable decline occurred in 2008, with the S&P 500 dropping nearly 57% as the subprime crisis led to a monetary crisis.

Disclaimer: This news is not investment advice. Assess the risks yourself before making any investment decisions.

Join my telegram channel.

All portfolio leaders are here.

Reviews: