NFT meaning

NFT (abbreviation of the English “non-fungible token”) are non-fungible tokens that represent titles of ownership of various digital objects: texts, images, audio recordings, digital works of art, game items or characters, domain names, financial instruments, club cards etc.

If cryptocurrencies are conditionally fungible – for example, one bitcoin in one user’s wallet is equal and identical to one bitcoin in another user’s wallet (if you do not take into account traceability of origin through blockchain analytics tools), then one NFT token representing a picture is not equal to one NFT token of another user, since these can be different paintings by different artists with different values.

Each of the NFT tokens is unique and exists in the singular. Non-fungible tokens are unique – they cannot be copied. Each of them contains identifying information recorded in smart contracts. This information makes each NFT different from the other.

With the help of NFT, developers have solved the problem of securing ownership of digital objects. Information about the owner and his tokens is fixed in the blockchain. It is impossible to replace or delete information.

How did NFT come about?

Experiments with NFT began with the emergence of solutions such as Colored Coins (in 2013) and Counterparty (in 2014), which made it possible to tokenize assets on the bitcoin blockchain.

In 2017, the NFT project Rare Pepe Directory became famous – memes with Pepe the frog. The first NFT on the Ethereum blockchain in June 2017 was a project by the Larva Labs team – CryptoPunks pixel portraits. Initially, there are 10,000 cryptobanks distributed free of charge, but at the time of writing, they are already perceived as valuable blockchain antiques.

The first hype in the history of NFT was CryptoKitties. Launched in November 2017, the project makes it possible to breed cats. The user takes two NFT cats and produces from them NFT offspring of varying degrees of rarity, which he keeps or sells.

Many projects started experimenting with NFT breeding mechanics, adding other gameplay elements. For example, L2 games have emerged, built by third-party developers on top of CryptoKitties. The idea of such games is that not NFTs are created for the game, but games are created for already existing tokens. This idea is being developed by the Enjin project, which raised 75,000 ETH in an ICO at the end of 2017, and Eminence from André Cronier.

L2-application Wrapped Kitties allows you to wrap NFT cats in ERC-20 tokens. If the user cannot afford an expensive token, he can buy a part of it. As of March 11, 2021, the market capitalization of wrapped NFTs was $ 5.098 million.

Another project with a game element is Aavegotchi, which combines the mechanisms of the Aave DeFi landing service and the popular Tamagotchi toy.

The so-called Hot Potato-style bubble games have also appeared. Their rules are simple: each next NFT buyer pays more than the previous one. After someone has bought NFT from the developers, with each subsequent resale, the price of the asset is automatically increased according to the specified algorithm.

Tokenization of non-fungible digital objects quickly spread to card games (Gods Unchained), RPG (MyCryptoHeroes, Neon District), sports games (F1 Delta Time, Sorare), virtual worlds (Decentraland, Cryptovoxels), Ethereum domain names (ENS), traditional financial tools (yinsure).

The tokenization of digital art has received a new impetus: it has become even easier to create, trade and receive royalties from NFTs.

All classes of digital objects are actively traded on marketplaces. The NFT production and turnover ecosystem includes dozens of projects.

What token standards are used to issue NFTs?

Most of the non-fungible tokens are issued based on Ethereum in several major standards. The standardization of the NFT issuance guarantees a higher degree of interoperability (the ability of blockchains to interact with each other), which allows such non-fungible tokens to be transferred between different decentralized applications.

ERC-721 is the first and most popular implementation of NFT on Ethereum, extending the capabilities of the basic ERC-20 standard. In it, each type of tokens requires a separate smart contract.

Later, other versions of the standards appeared:

- ERC-998 is an evolving standard that allows the creation of a composite token – a digital asset that “owns” another digital asset. For example, the ownership of a playable character in a computer game is represented by one non-fungible token, while the rights to its equipment are represented by another. ERC-998 allows you to combine them into one token.

- With ERC-875 it is possible to send multiple collectibles in one transaction.

- ERC-1155 is an improved standard that allows you to work with several types of tokens at once through one smart contract. Such a contract can simultaneously contain both NFT and ordinary tokens. It allows you to store a wide range of items, from armor and weapons to magic potions and scrolls, where each of these items can be interchangeable if multiple copies of the same type are available. If the game contains tens of thousands of elements, then in the case of ERC-721, you need to create as many separate smart contracts. ERC-1155 allows you to combine ERC-721 tokens in one contract, each of which is stored with its own set of data. As a result, the playable character consists of all the underlying NFTs: weapons, armor, special characteristics, and even other ERC-20 tokens.

Another NFT standard that is being actively worked on is the Blockchain Bean Asset or BBA. The authors of the Ethereum standard are the Blockchain Game Alliance, which includes prominent companies in the gaming market, such as Ubisoft. As part of this standard, the developers intend to integrate the possibility of decentralized storage of content.

NFTs are not limited to Ethereum – they also exist on NEO, EOS, Tron, Flow, Cosmos and other platforms.

The Mythical Games team, in collaboration with game developers and the EOS ecosystem (Greymass, Cypherglass, Meet.One, Scatter and Blocks.io), are planning to launch their own NFT standard for EOS: dGoods.

Tron also attracts game developers. For example, Biscuit and EOS game creator Knights intend to move to the Tron blockchain. It is planned to unite gaming projects, where the possibility of purchasing and selling NFT for both cryptocurrencies will be realized.

NFT ecosystem structure

| Aggregators | OpenSea | Wallets | Exchanges |

| Protocols for NFT Funding | NFTX | Upshot | NFTfi |

| Protocols for NFT Release | SupeRareZora | Nifty Gateway Rarible | Foundation Mintbase |

| Sidechains and second-tier solutions | Immutable X | Axie Infinity | Efinity |

| Network | Flow | Ethereum | WAX |

NFT projects are developed mainly in Ethereum, Flow and WAX networks, as well as on the basis of second-tier solutions and sidechains.

Release platforms and marketplaces can be categorized as follows:

- Aggregators for buying and selling NFTs.

- Generic release protocols enabling NFT creation.

- Niche marketplaces: Marketplaces or art issuers dominate, but NFT blogs like the Mirror and music marketplaces like EulerBeats are also slowly emerging.

Where is NFT used?

| Images | Paintings, illustrations, design, photography, stock images. Audio Music, podcasts, radio programs. |

| Audio | Music, podcasts, radio programs. |

| Written content | Blog posts, tweets, instructions. |

| Metaverse | 3D models, internal game assets, maps, augmented reality assets. |

| Video | Films, serials, streams, shows, videos. |

| IP | address space, domains. |

What NFT marketplaces are there?

NFT aggregators

NFT marketplaces / protocols for the release of art objects

Universal marketplaces / release protocols

Niche content release protocols

Art marketplaces are a kind of combination of auction houses, galleries and release protocols.

Nifty Gateway and SuperRare themselves bring reputable creators to the platforms.

Other marketplaces, OpenSea and Rarible, are more versatile and similar to Etsy or eBay, where creators can display their own artwork.

OpenSea is the largest NFT market by trading volume and supports the trading of ERC-721 and ERC-1155 tokens, which have been used to create over 4 million unique digital items.

Collectible NFTs can be traded on the Auctionity platform, which allows you to sell and buy in-game assets in the auction mode.

The KnownOrigin trading platform, launched in February 2018, may be of interest to designers and artists. Using the internal token KnownOriginDigitalAsset (KODA) of the ERC-721 standard, users can purchase art objects, as well as confirm the authenticity and authorship of their creation. KnownOrigin offers over 19,000 works of art for sale.

The Pixura project offers templates for NFT marketplaces that allow you to launch marketplaces with any ERC-721 tokens.

How do you make money on NFT?

1. Purchase of individual NFTs and subsequent resale.

NFT can be purchased from marketplaces like OpenSea and Rarible. OpenSea allows you to buy and sell NFTs with different assets, but the default currency is ETH. In the future, you can try to sell NFT above the purchase price.

2. Purchase of native tokens of NFT projects.

Users buy RARI governance tokens from Rarible. RARI token holders can vote on project updates and participate in moderation.

They also show interest in AXS tokens from the Axie Infinity game, as well as in MEME from the protocol of the same name, a project on NFT farming. Staking the MEME token allows you to unlock limited artwork by different artists or collectible cards.

Another governance token is SAND, the in-game currency in the Sandbox platform universe.

3. Lending to NFT collectors.

Many collectors are interested in borrowing against NFT collateral. This allows you to create an NFTfi marketplace. In the event of default by the borrower, ownership of the NFT passes to the lenders.

4. Buying tokenized ETFs.

The main idea behind the NFTX project is to bring liquidity to NFTs like CryptoPunks by creating tokenized $ PUNK index funds. The governance token is used by the community to govern the protocol.

5. Purchase of tokenized insurance policies.

Yearn.finance and its yield insurance project yInsure are popular in the DeFi and NFT sectors. Yearn.finance tokenized insurance policies can be traded on OpenSea and Rarible marketplaces.

There is no single correct way to collect and earn NFTs. It should be borne in mind that such tokens are low-liquid, and the value of each item is subjective. To analyze the situation and prices in a segment, you can use analytical resources like NonFungible.

What is PFP?

PFP (Picture for Proof) is a type of non-fungible token used as profile pictures or “avatars”. Many market participants, ousted by the skyrocketing prices for CryptoPunks, were looking for more affordable variations of NFT.

This led to the launch of numerous projects in the new sub-segment and the emergence of the “PFP mania”. Twitter, Discord, Telegram and even LinkedIn users have started changing their profile pictures on NFT.

Bored Apes Yacht Club (BAYC). Data: Finematics.

One of the first NFT / PFP projects was the Bored Apes Yacht Club (BAYC).

Yuga Labs launched the NFT Bored Ape Yacht Club series in April 2021. This is a collection of 10,000 high quality images of “bored monkeys” with any combination of accessories – pipes, necklaces, glasses, hats. Among the characters there are both ordinary primates and exotic ones – with golden skin, crowns, etc./p>

The “Yacht Club” in the name of the collection implies that each NFT is a club card that gives its member privileges: access to exclusive merchandise and an online graffiti board, as well as bonuses from the creator of the Yuga Labs series in the form of NFT dogs.

Yuga Labs originally sold Bored Apes for 0.08 ETH. In September 2021, the cheapest monkey cost about 40 ETH. In the same month, the auction house Sotheby’s sold a set of 107 Bored Ape Yacht Club for $ 24.4 million.A set of 101 tokens from another collection from Yuga Labs – Bored Ape Kennel Club – sold for $ 1.8 million.

The avatar mania has given rise to many other PFP / NFTs. Most of them are primitive clones of popular projects, but there are exceptions.

The Pudgy Penguins collection includes 8,888 penguins with different features and accessories – scarves, T-shirts, glasses, mohawks, etc.

The World of Women collection of images of women is designed to bring more variety to the world of NFT and to represent the maximum number of human types.

Alongside brand new NFTs, already successful project teams are launching collections inspired by their original creations. The most famous examples of this kind are the Meebits collection from the creators of CryptoPunks and the Mutant Apes from the creators of Bored Apes. This approach allows you to expand existing user communities to include people for whom the original collections were not available.

While PFP remains the focus of NFT users, new and interesting niches are emerging in the sector. One of them is generative art. It is at the intersection of art and programming: an artist-programmer writes an algorithm that artificial intelligence uses to create an image.

The art object is created when a new NFT is released and uses the transaction hash that is always associated with this token. This model allows market participants to feel involved in the creation of a work of art: two users release an art object from the same collection, but get different results.

Autoglyphs. Data: Finematics.

An example of generative art is Autoglyphs, a 512-piece collection of on-chain ASCII art. They are rendered thanks to the implementation of the Autoglyphs smart contract. For each object, the probability of creating certain patterns is individual, therefore, individual fragments are more rare. The average price of Autoglyphs NFTs sold over the past week was $ 1.15 million.

Many popular generative art works are created on the Art Blocks platform, launched in November 2020. According to CryptoSlam, the trading volume on the platform in August 2021 exceeded $ 469 million.

Art objects are created on Art Blocks using a script written in the 5p.js programming language. Each collection has its own script stored on the Ethereum blockchain. A program written in 5p.js can create different geometric shapes with different structures, textures and colors depending on the goals of the creator.

The most prestigious Art Blocks Curated collection includes NFT Ringers by artist Dmitry Chernyak. In August 2021, Three Arrows Capital, a cryptocurrency venture capital fund, acquired Ringers # 879 for 1,800 ETH (about $ 5.8 million at the exchange rate at the time of the transaction). 1800 ETH is the maximum amount spent on Art Blocks. The previous record was 1000 ETH ($ 3.3 million) for Fidenza # 313 by artist Tyler Hobbs.

Most expensive generative art sold on the Art Blocks platform. Data: Finematics.

What other directions for NFT development are there?

Fractionalization of NFT

The non-fungibility and indivisibility of NFTs makes them low-liquid. The rapid growth of interest in a short time has led to a jump in the average price of collections and made them inaccessible to retail investors. This problem is intended to be solved by the protocols of fractionalization of non-fungible tokens.

The fractionalization process includes two stages: token splitting and buyback. In the first step, the owner of the tokens creates the storage. The NFT is then sent to the smart contract and the owner receives fungible tokens (factions or shards) representing 100% of the ownership. Usually, most of the shards are put up for sale at a specified price on popular decentralized exchanges – Uniswap or SushiSwap.

After the initial placement of shards, the NFTs that they are backed with can be obtained entirely in two ways. The first is to collect 100% of the shards. This can be problematic for a variety of reasons. For example, when a liquidity pool is created on Uniswap or its clones, part of the LP token is burned so that there is always a non-zero amount of liquidity on the decentralized exchange. Therefore, after listing on a decentralized exchange, no one can receive a token in full. This means there is a risk that the NFT will remain frozen forever.

To avoid this situation, NIFTEX, the protocol for generating ERC-20 index tokens backed by NFT, and the Fractional. Art fractionalization platform use a buyback model.

If the user has NFT shards and wants to receive the entire token, the other shard holders can be offered a buyout offer. The user sets the redemption price of the missing shards in ETH and deposits this amount and his shards into a smart contract. On NIFTEX, the rest of the NFT’s shard holders have two weeks to reject or accept his offer.

To reject the offer, they need to fully repurchase the shards at the offered price. If this does not happen within two weeks, the offer is considered accepted: the user receives the desired NFT, the shards put by him are burned, and his ETH is used to redeem the remaining shards.

On Fractional.Art, each NFT has an agreed minimum price determined by the weighted average of the shard holder’s votes. This model avoids ransom spam. If less than 50% of shard holders have voted, no minimum price is set.

Any outside party can deposit funds equal to or greater than the minimum price, which allows the auction to be launched. At the end of the auction, the highest bidder can withdraw the NFT and the shard holders can redeem the proceeds from the sale.

NIFTEX uses a more complex buyback model. Only the holder of a certain number of shards can start the redemption mechanism. If he owns x% of the shares, he can launch the buyback at $ N value by depositing $ N * (1-x%) into the smart contract.

While a bidder can bid, other shard holders are free to collectively reject the buyout within a specified time frame for the same cost. They can do this by pooling funds and buying out the share of the user making the offer. Since the proposer cannot avoid the ransom, he is not interested in making offers with a low value.

If the buyback does not occur, the offer is accepted. The proposer can withdraw the NFT and the profits are distributed among the remaining shard holders.

Ransom rejection requires social coordination. Upper-end NFTs are not listed on NIFTEX as it is difficult to coordinate the actions of thousands of holders. Currently, the market capitalization of most sharded non-fungible tokens on NIFTEX does not exceed $ 1 million.

Homogenization and redemption

Fractionalization is not suitable for non-fungible tokens of the lower price segment, since their low capitalization makes it difficult to promote a liquid market. To attract more affordable NFTs, you need a vault that accepts deposits of different non-fungible tokens with the same market value. These can be tokens from one collection without unique characteristics.

Users who deposit eligible NFTs receive a certain amount of fungible storage tokens. By burning some of these tokens, the user can withdraw a random token from the storage.

Homogenizing low-end NFTs allows for faster pricing for conventional collections as it provides buyers and sellers with liquidity. While the homogenization model conflicts with the fundamental idea of non-fungibility of tokens, it is convenient for speculators who wish to have access to conventional NFTs without owning them.

Vault tokens play the role of financial derivatives in relation to the market dynamics of the underlying NFTs. An example is the PUNK store on NFTX. By depositing CryptoPunk, the user can issue 1 vault token PUNK. A 5% deposit commission is prorated among the liquidity providers of the PUNK / ETH market on SushiSwap.

This model encourages passive market making and provides liquidity. In exchange for a deposit, the user receives only 0.95 PUNK tokens. He may not pay a commission if immediately after the issue he uses PUNK tokens to provide liquidity for PUNK / ETH for at least 48 hours.

For 1 PUNK, you can redeem a random CryptoPunk from the storage. The site recently added a targeted buyback option. It allows you to select any NFT from the storage for redemption with a premium of 5% (1.05 PUNK in this case). As of September 17, 2021, the total amount of funds from commission fees on NFTX exceeded 742 ETH ($ 2.48 million). The NFTX was running 8146 NFTs.

On the NFT20 site, the vaults work according to a similar scheme, but the deposit fee goes to the treasury of the protocol and is distributed among the holders of the MUSE token.

Problemy sektor NFT Khraneniye NFT Khraneniye NFT osushchestvlyayetsya po-raznomu. Nevzaimozamenyayemyye tokeny otlichayut takiye kharakteristiki, kak dokazuyemoye pravo vladeniya, verifitsiruyemost’ i dostupnost’ istorii proiskhozhdeniya i vladeniya. Eti parametry dostizhimy blagodarya tomu, chto NFT sozdayut na Ethereum i drugikh blokcheynakh. Odnako fayly izobrazheniy nevozmozhno khranit’ na samom blokcheyne, poetomu bol’shinstvo NFT prosto vklyuchayut ssylku na art-ob”yekt i yego metadannyye, kotoryye khranyatsya ofcheyn.

NFT sector problems

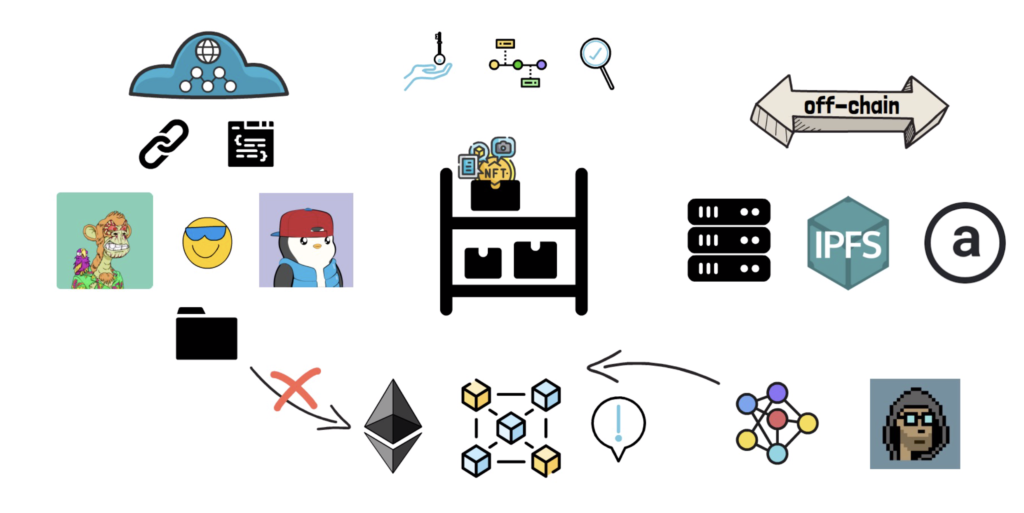

NFT storage

NFT storage is handled in different ways. Non-fungible tokens are distinguished by characteristics such as provable ownership, verifiability, and availability of origin and ownership history. These parameters are achievable due to the fact that NFTs are created on Ethereum and other blockchains.

However, image files cannot be stored on the blockchain itself, so most NFTs simply include a link to the art object and its metadata, which is stored off-chain.

NFT storage. Data: Finematics.

To store data off-chain, some projects use centralized servers, while others upload metadata and art objects to IPFS. Another solution is the Arweave Storage Protocol (AR). The exceptions are generative art and standalone low-resolution NFTs that can only be stored on-chain.

Intellectual property rights

Some NFTs allow their owners to freely dispose of them, other projects restrict the potential use of their tokens, but also endow the creators with intellectual property rights.

Ethereum gas fees

Most NFTs are issued on a “late is late” basis. This leads to the invasion of bots and jumps in gas prices. As a result, ordinary users are either not allowed to sell or overpay to issue tokens. The problem of rising gas prices can be solved by integrating NFT with second-tier solutions.

Infrastructure for buying, selling and displaying NFTs

Currently, the lion’s share of NFT trading volume falls on the largest marketplace OpenSea, where projects are centrally cared for. The solution to this problem may be the decentralization of OpenSea and the emergence of other decentralized solutions.

NFT as a Potential Money Laundering and Tax Evasion Tool

In assessing the sector, traditional artists are divided into two camps: some, for example, Damien Hirst, see NFT as a promising new direction, others, such as David Hockney, call the segment “the abode of crooks and scammers.”

The huge turnover and traditional way of the art trading industry make it attractive to criminals who want to legalize illegal income. The regulation in this area is becoming stricter, so money launderers are looking for new tools to implement their schemes. NFT can become one of such tools. There are no problems with transporting tokens, they do not need to be stored in a physical place, and most platforms focused on this segment of the industry operate with minimal or no KYC requirements.

Potential money launderers can really take a look at NFT marketplaces. The largest of these, OpenSea, identifies clients by an Ethereum wallet and allows “private sales” of digital assets. The latter are auctions available only to pre-specified addresses.

Tim Swanson, founder of the consulting company Post Oak Labs and former director of market research at the blockchain consortium R3, believes that non-fungible tokens are already being used not only for money laundering, but also for tax evasion.

According to him, the mechanism of money laundering with the help of NFT is as follows: a well-known account with large tax liabilities buys it [token] from an unknown account and then resells it to a third account at a significantly lower price, taking a loss that compensates for the aforementioned tax liabilities. This is repeated over and over again.

According to Andrey Tugarin, Managing Partner of GMT Legal, there is no legal regulation in the NFT market in the area of combating money laundering – the segment remains a gray area in which it is very easy to “clear” funds. Therefore, we should expect a surge in laundering deals with non-fungible tokens, especially against the background of tightening regulation of the material arts market.

However, cryptocurrencies have also been linked to money laundering, which hasn’t stopped them from becoming a multi-billion dollar industry.

The fact that NFTs, like other digital assets, are issued on the blockchain, which means that the history of their transactions can be traced if desired, also speaks against money laundering. The seller and the buyer of the token can be identified at the “bottleneck” of the proposed scheme – during the conversion of cryptocurrency into fiat.

NFT market regulation

Lawyers at New York-based firm Kobre & Kim consider the lack of regulation to be one of the main problems of the new market. They noted that the US supervisory authorities have already paid attention to this segment of the industry and, probably, intend to bring it into the legal field. In particular, marketplace operators can be equated with art dealers.

If NFT is recognized as cryptocurrencies, the operators of the respective platforms will also be required to comply with AML / KYC requirements, as they are implemented by local bitcoin exchanges.

There is also a third option – non-fungible tokens, at least some of their varieties, can be recognized as securities. Earlier this was announced by the SEC Commissioner Hester Pierce. In this case, the Commission will directly deal with the regulation of the market.

According to former USA Today journalist Isaiah McCall, NFTs are “doomed to regulation.” If you look at how government departments have systematically put things in order in the cryptocurrency industry, you can see that this has not been avoided by any of its segments – from ICOs to DeFi and stablecoins.

A similar fate awaits non-fungible tokens, which will make money laundering difficult with their help. The NFT has already been highlighted by some financial regulators and intergovernmental organizations like the FATF.

How is the NFT industry evolving?

From February 4 to March 4, 2021, the trading volume of non-fungible tokens (NFT) on the 12 largest platforms reached a record $ 480 million.

In addition to representatives of the cryptocurrency industry, entrepreneurs, politicians and the creative elite have shown interest in the sector.

Among those who drew attention to NFT were actress Lindsay Lohan, Vermont Senator Bernie Sanders, author of the Nyan Cat meme animation and a Russian artist.

Tokenized tweets, gifs, presidential portraits and music albums raise millions of dollars at auction in no time. During February 22, 2021 alone, users spent more than $ 64 million on NFT, excluding expensive lots. Some copies, such as CryptoPunks, were sold for 90-400 ETH, and the most rare – for a record 4200 ETH.

On March 11, 2021, the British auction house Christie’s sold NFT artist Mike Winkelmann, known under the pseudonym Beeple, for $ 69.3 million – a record price in the history of NFT.

In the second half of February 2021, the user base of the NBA TopShot NFT marketplace with basketball-themed cards increased significantly – over 45,000 users visited the platform on February 16 and 22.

OpenSea broke the 1,000-day mark in February. On its busiest days, the third largest marketplace, CryptoPunks, recorded 350 users.

The number of transactions is closely correlated with the number of users. On February 22, the NBA TopShot platform recorded over half a million transfers, OpenSea over 4,000, and CryptoPunks 1,400.

Along with Ethereum, new, high-performance blockchains like Solana, Tezos and Polygon are increasingly used to issue NFTs.

Another direction in the development of the NFT segment is the creation of DAOs, intended primarily for the purchase of non-fungible tokens. Users with limited funds can associate with others in the DAO. Co-purchased NFTs can be tokenized and distributed to members. Under this scheme, PleasrDAO acquired Dogecoin NFT for $ 4 million.

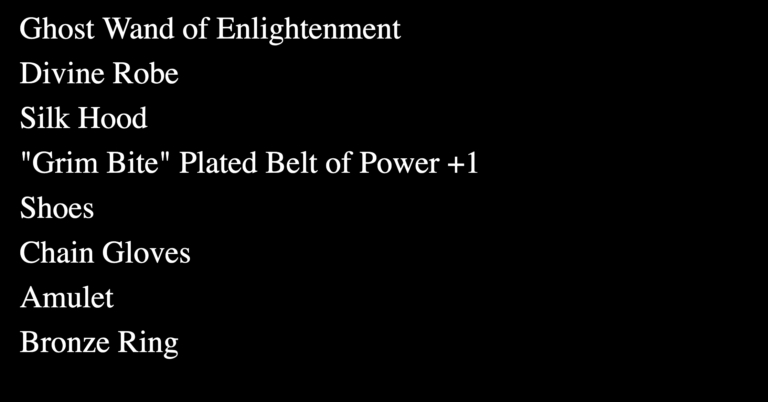

One of the innovations on the market is the Loot project. Loot NFTs contain only metadata that describes a set of items in a hypothetical computer RPG. Members of the Loot community have the right to decide how to use and even how to render these items.

Loot NFT. Data: Finematics.

In the first half of 2021, the total NFT market was $ 2.5 billion.

From May to August 2021, the share of DeFi protocols in the traffic of decentralized applications (dapps) monitored by DappRadar decreased from 45% to 18%, yielding to projects in the NFT and GameFi segments (41% and 55%, respectively). The increase in the share of the NFT segment was explained by analysts by a new wave of interest in non-fungible tokens.

Subscribe to Monetka.blog news on Telegram: Monetka.blog – The latest information about the world of internet earnings.

Reviews: