The author of the book is Seifedin Ammus, professor of economics at the Lebanese American University. Ammus is a supporter of the Austrian school of economics. He advocates the self-organization of the free market and libertarianism. From the standpoint of the Austrian school, the author talks about the evolution of money from primitive societies to the advent of cryptocurrency. He explains why Bitcoin is one of the biggest economic breakthroughs in history.

Bitcoin is the newest medium that serves as money. It is an invention that harnesses the technological capabilities of the digital age. It is used to solve the problem facing humanity from time immemorial: the movement of economic value in space and time. To understand Bitcoin, you first need to understand what money is, and for that you need to study its functions and history.

The simplest way to exchange value is to exchange one valuable item or product for another. This process of direct, direct exchange is called barter. However, this format works only in narrow circles with a limited range of goods and services. For example, in some hypothetical community of 15 people isolated from the world, there is not much room for the division of labor and the market. Therefore, each individual will be able to produce essential goods and exchange them directly with a neighbor. Barter has always been present in human society and is still used today. But today it is extremely impractical and is used only in exceptional situations. Usually these are people who are personally or fairly close friends with each other.

In larger and more complex economies, the individual gets the opportunity to specialize in the production of certain goods and enter into business relationships with a wide range of people. Here, personal acquaintance is no longer necessary for exchange. Consequently, offsetting goods, services and works is meaningless. The wider the market, the more prospects for production and exchange, but the more acute is the problem of mismatching requests. If you intend to offer the artisan in return, he is not interested. And the point here is not only in different tastes and needs – the problem is much deeper and is characterized by three specific aspects.

The first is scale mismatch: the value of what you need is significantly different from what you have. And dividing one of the goods into small parts is impractical. Imagine you want to buy a house and pay with shoes. You will not be able to buy it in parts equal in value to one pair. And the owner of the house is unlikely to need a mountain of shoes to cover its cost. The second aspect is the mismatch in time and timing. Let’s say your product is perishable, and you want to purchase something valuable and durable. For example, it will be extremely difficult for you to accumulate the required number of apples for a one-time payment for a car. Because as long as you pick up so many fruits, most of them will simply rot. The third aspect is spatial. Let’s say you want to sell a house in one place and buy in another, and most homes, as we know, are not transportable. These three aspects make barter highly impractical and force them to resort to tiered exchange to meet their economic needs.

The only way to solve the problem is through indirect exchange. You find a product that your seller needs, and someone who is ready to sell it for your product. This intermediate commodity becomes a medium of exchange. In principle, anything can serve them, but as the market grows, the task of finding the right product becomes more complicated and conducting several exchange chains to get what you want becomes impractical. In such a situation, a more effective solution will certainly be found, if only because the one who uses it achieves the goal much easier and faster. This will be a single medium of exchange (or at least a limited set of such means). A product or object that takes on the role of a universal means of payment is called money.

Exchange intermediation is the functional essence of money. In other words, it is a commodity that serves not for consumption (consumer goods) and not for production (investment, or capital goods), but exclusively for exchange for other goods. Although investments are also intended to generate income that can be exchanged for new goods, they have three differences from money. First, they involve interest that the money itself does not generate; second, they imply the risk of failure, while cash is considered the safest financial instrument; thirdly, they are less liquid due to the high cost of transactions when they are spent. This explains the steadily increased demand for money and the inability of investments to completely replace them. Human life is unpredictable, and we are not given to know when and how much money may be needed. Common sense and age-old wisdom suggest that part of the savings should be kept in the form of “live” money, since this is the most liquid asset.

If necessary, it can be spent at any time, and the risk of its storage is much lower than with an investment. However, we pay for the convenience and reliability with unpurchased goods that could have been bought with deferred money, and not received income from a possible, but not made investment.

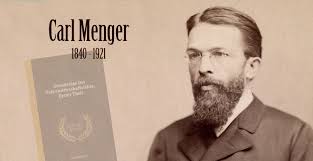

Exploring human behavior in market conditions, Karl Menger – the creator of the Austrian school of economics and the founder of margin analysis – identified a key property that allows a product to take on the functions of a means of payment, and called it market attractiveness, or the liquidity of a product. This refers to how quickly the product can be sold with minimal loss in price.

Basically, there is nothing that defines exactly what can or cannot be used as money. Anyone who buys a thing, not for its own sake, but for the purpose of exchanging it for something else, actually turns it into currency. As with many things, the choice depends on the person and the circumstances. Throughout the history of mankind, a variety of objects and materials have played the role of money: not only gold and silver, but also copper, shells, large stones, salt, livestock, treasury bills, jewelry, and sometimes even alcohol and cigarettes. The choice of a person is subjective, so there is no right or wrong choice of a means of payment. However, every choice has consequences.

The relative market attractiveness of goods – and therefore their ability to serve as currency – can be gauged by how well they solve the aforementioned problem of mismatching desires in all its three dimensions: scale, time and space. To equalize the scale, the means of payment should be easily divided into small units or form large batches, allowing the owner to sell it in any quantity. To service transactions in different geographic locations, it is necessary that the currency be easy to transport and carry with you, therefore the most convenient means of payment, as a rule, are distinguished by a high cost per unit of weight. Since both conditions are easy to fulfill, one might decide that many items and materials could potentially play the role of a means of payment. But the third aspect, the temporal aspect, is the most difficult problem.

To solve the timing problem, the medium of exchange must have a sustainable value that allows the owner to accumulate it. This is precisely the second function of money – accumulation and saving. First of all, the currency should not be subject to damage, decay and other destructive processes. Anyone who decides to convert their wealth into apples, oranges or fish will soon realize their mistake. Probably, after that, he will not have to worry about the safety of assets for a long time: there will simply be nothing to store. However, physical safety itself is a necessary, but not a sufficient condition for the long-term attractiveness of a product, because it can significantly lose value, even if its condition does not change. In order for the value to be preserved for a long time, it is necessary to control the quantity of the product: it should not increase significantly during the time while its holder owns it. A common characteristic of all types of money known to us is the presence of a mechanism that limits the production of new units in order to avoid a decrease in the value of existing ones. Here, a distinction should be made and two types of means of payment should be distinguished: hard, whose stock is difficult to increase, and soft, whose stock is replenished easily and quickly.

You can determine the nature of the currency using two quantitative indicators related to its turnover. The first is the available reserve, which consists of all units and batches ever produced minus what was damaged or destroyed. The second is the inflow, that is, the number of new units that will be manufactured in the foreseeable future. The ratio between new lots and reserve is a reliable indicator of the hardness / softness of money and its general legal tenderness. A low ratio means that the available stock could rise sharply if the currency is used to store assets. Such a currency is unlikely to retain value when chosen as a store of value. The higher the reserve-to-inflow ratio, the more likely it is that the tender will not depreciate over time, and vice versa.

If the population chooses a solid means of payment with a high ratio of reserve and inflow, then buying it to create savings will increase demand and, consequently, the price, which, in turn, will push issuers to manufacture new batches. But, since the inflow is small compared to the reserve, even its sharp increase is unlikely to significantly reduce the price. However, if the population decides to accumulate soft currency, it will not be difficult for issuers to issue large quantities of it. As a result, the means of payment will depreciate, devaluation will occur and savings will quickly “burn out”. Therefore, a soft currency is of little use for long-term storage of assets.

I call this the “soft currency trap”: the reserves of any means of payment in which savings are kept must be replenished, but if the reserve is replenished easily, this will soon wipe out the savings. A natural consequence of such a trap is the emergence of natural or artificial mechanisms that restrict the inflow of foreign exchange into the market, which helps to avoid devaluation. Therefore, the means of payment should not be too affordable or easy to manufacture, otherwise the temptation to make new money will destroy savings, and at the same time all incentives to invest in this means of payment. Whenever natural, technological or political processes led to a rapid replenishment of the stock of one or another currency, it lost its monetary status and was replaced by another means of payment with a higher ratio of reserve to inflow. We’ll talk about this in the next chapter. Shells were only used as money as long as they were hard to find. Cigarettes are used as legal tender in prisons precisely because they are difficult to obtain. The same is true for national currencies: the slower the stock grows, the higher the likelihood that if citizens decide to keep their savings in this currency, they will not lose.

When humankind invented efficient ways of catching shellfish, communities that used shells as legal tender switched to metal or paper money. When the government turns on the printing press, the public begins to buy up foreign currencies, gold, and other relatively reliable assets. Unfortunately, the 20th century has provided us with many such sad examples, especially in developing countries. The most “stable” means of payment – those whose restrictive mechanisms have proved to be more reliable than others – are hard currencies in the full sense of the word. Monetary funds compete in any era; the outcome of the competition depends on the impact of technology on the supply-to-inflow ratio of each currency, as will be shown in the next chapter.

So, although people are free to use almost any object or commodity as a medium of exchange, those who choose hard currencies benefit, because their reserves depreciate little over time due to a small inflow. Those who prefer soft currencies are likely to suffer losses due to the rapid growth of its stock and, as a consequence, the fall in the market price. Someone is helped by a sober calculation, someone is a bitter experience, but the result is the same: money and material benefits most often come to those who invest in hard and popular types of currencies. However, monetary reliability itself is also not a constant property. In different eras, as the technological capabilities of society changed, the hardness of various currencies also changed, and, consequently, their market attractiveness. The choice of the optimal means of payment has always been determined by technological realities, which also leave an imprint on market processes. Therefore, economists of the Austrian school try to avoid excessive objectivity and define a reliable currency not as a specific commodity or product, but as any means of payment that appears on the market due to the free choice of participants, and not imposed by the authorities, or as a means of payment, the value of which is established in the course of the market. interaction, and not an order “from above”. Free market competition of monetary units is a ruthlessly effective mechanism for finding hard currency, because it allows only those who have chosen the “right” means of payment to accumulate significant assets. There is no need for the government to impose on citizens the most solid means of exchange; societies have skillfully chosen their currency even before governments were created. Any intervention from the top will only complicate monetary competition – if it has any effect at all.

The individual and social implications of the choice between hard and soft currencies are much deeper and deeper than simply financial loss or gain. Those who can keep their savings in hard currency have a much wider planning horizon than those whose savings are at risk. The reliability of the monetary means (that is, the ability to maintain value for a long time) primarily determines the attitude of citizens to the present and the future, or their temporal preference – one of the key concepts of this book.

In addition to the ratio of reserve and inflow, the liquidity of monetary funds is determined by another important criterion – popularity. The more people accept a means of payment, the more liquid it becomes and the higher the chances of buying or selling it without significant losses. In a social space with a lot of peer-to-peer operations – as shown by computing protocols – dominant exchange standards often emerge, as the benefits of joining the network increase exponentially as the network expands. Thus, Facebook and two or three other social networks dominate the market, where hundreds of similar projects were initially created and promoted. Likewise, any device that sends email must use IMAP / POP3 to receive messages and SMTP to send them. There are many alternative quite acceptable protocols, but in practice almost no one uses them, because then the user will be cut off from most mail servers based on IMAP / POP3 and SMTP. It is the same with currency: one or more means of payment inevitably becomes the most widespread, because it is easily exchanged and recognized everywhere. As we have already mentioned, the medium of exchange is not acquired for its own sake, but for its liquidity.

In addition, the wide popularity of the means of payment allows any value to be expressed through it, as a result of which it can perform the third function of money – to serve as a unit of account. In an economy where there are no generally accepted means of exchange, the price of each good would have to be expressed in terms of the other. There would be a lot of options, which would make the calculations extremely difficult. In an economy where there is a universal means of payment, the value of any commodity is expressed in the same units. Money serves as a metric system for regulating the exchange of value. Producers are rewarded to the extent that they provide something of value to others. Consumers understand how much they have to pay to get what they want. Only the availability of a universal medium of exchange makes complex economic calculations possible, and with it the division of labor in finance, the accumulation of capital and the expansion of markets. The functioning of a market economy depends on prices, and prices, strictly speaking, depend on a single medium of exchange that reflects the demand for various goods. In the case of soft currencies, the ability to continually increase its stock will make it difficult to adequately reflect prices and costs. Any unexpected change in quantity will reduce its accuracy as an indicator of economic processes and a measure of value.

Having a single medium of exchange stimulates market growth and allows it to reach everyone who is willing to use this medium. The wider the coverage, the more opportunities for profit from exchange and specialization, but more importantly, the structure of production becomes more complex. Manufacturers can specialize in the manufacture of capital goods that will only lead to final consumer goods over time, thereby increasing efficiency and improving quality. In the economy of primitive societies, for example, fish production was limited to going ashore and catching fish with their bare hands. The entire process from start to finish took several hours. As the economy grew, more sophisticated instruments appeared, a need arose for capital goods, and their release significantly lengthened the process, although it increased its effectiveness. In the modern world, specially equipped vessels are used for fishing, which take years to develop and whose service life is calculated in decades. Such vessels go much further than fishing boats, and, therefore, we get fish that were not on the table of our ancestors. Trawlers are practically not afraid of bad weather; they can continue to fish in extremely difficult conditions where more primitive vessels would be forced to return to port. Capital investment lengthened the production process, but also significantly increased labor productivity. As a result, we get high-quality products, unimaginable in a primitive economy with the simplest tools and without capital goods. But none of this would have happened without money as a medium of exchange (ensuring the division of labor), a store of value (orienting towards the future and encouraging investment instead of consumption) and a unit of account (allowing to calculate profits and losses).

Throughout the history of mankind, many objects and goods played the role of money, and the degree of hardness / softness depended on the technological capabilities of each era. From shells, salt, livestock, silver, gold, treasury bills, backed by a gold reserve, to the current state means of payment, each new round of technological progress allowed us to adopt a new type of currency with its own advantages and, of course, pitfalls. By examining the history of the tools and materials used as money at different times, we can isolate the characteristics that make a medium of exchange good or bad. Without this knowledge, it is impossible to understand how bitcoin functions and what is its role as a monetary instrument.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

For a quick communication with me, write to the telegram.

All crypto articles are here.

Reviews: