Due to the high pace of development of the crypto industry and various sectors, I decided to make a selection of the most relevant opportunities to make money in the crypto.

If you still think that crypto can only be earned by speculating on the price of high leverage futures, then this article is for you.

So, here are 10 ways to make money on crypto in 2021-22.

ICO and IEO

It’s no secret that the best investments are investments in projects at the early stages of their development. Namely, on crowdsales, which often bring good returns on the initial investment.

ICO (Initial Coin Offering) is a process by which a project raises capital. The mechanics are similar to issuing shares during an IPO, only tokens or coins are issued instead of shares.

This is done in order to raise funds, while retaining equity capital, but also increasing the community and increasing the popularity of the project.

As users, this is a way to make money on the future price of the token, because if the project has proven itself well in the market, there may be significant demand for its token after the ICO. And also this is an opportunity to be among the first to take advantage of the access to the new service.

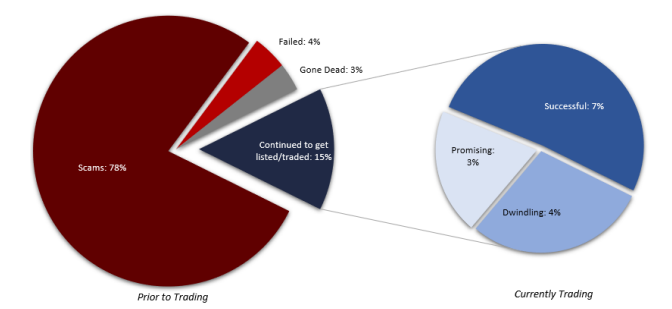

Of course, ICO is very risky, because due to the lack of control or initial requirements for the project, a huge number of token sales are a scam. As ICOs began to gain traction, a 2018 Satis report for Bloomberg stated that nearly 80% of ICOs were considered fraudulent at the time. Therefore, before participating in the ICO, study what you are investing in.

ICOs held on CoinList are especially popular now. CoinList is a centralized platform for token sales. On it you can buy new coins at minimal prices, which have the prospect of further growth before they go through a listing and go to exchanges. CoinList is attractive to investors as all coins (as well as their companies) that are added to the platform are thoroughly vetted. The risk of fraud is minimal. The advantages of CoinList also include a simple KYC procedure, an intuitive interface, and a small commission for operations (on average 0.5% of each transaction).

Over the 4 years of its existence, the platform has earned an excellent reputation and user confidence. The tokens listed on CoinList deserve attention, because this is an indicator of the uniqueness or usefulness of the project behind them.

Here are examples of some of them that showed good xx in the output:

- Mina: sale price 0.25, now 3.18

- Centrifuge: sale price 0.38, now 0.98

- Qredo: sale price 0.225, now 4.46

- NEAR: sale price 0.4, now 8.81

- Solana: sale price 0.22, now 179.25

- Flow: the price of the sale is 0.1, now it is 8.43.

There was a lock of tokens for a year and the project was able to stay at 100 x in a year. Users invested $ 1,000 and took more than $ 50,000 a year later. The remaining 50% of tokens will be taken away again in a year.

Successful tokens on Coinlist

But due to the high demand on the platform, the queues for sales began to reach 600 thousand users. Many of the participants create dozens or even hundreds of multiacquants in order to have more opportunities to get a good line and invest in the project. But even with such users, the coinlist began to fight, creating the possibility of pumping the so-called “Karma”, which gives a priority queue.

Is the coinlist up-to-date now? The last project that was co-listed is Biconomy. The lucky ones who managed to get into the sale were able to earn more than $ 20 thousand from $ 500. So yes, the coin listing is still relevant and quite profitable. It is ideal for beginners with small deposits. The main thing is, do not forget to correctly analyze projects, their metrics, tokenomics, which funds support them and how blocked the tokens are. Everywhere has its own nuances, so – DO YOUR OWN RESEARCH.

You can track token sales on the website from ICO Drops.

There you will find all the necessary information on the current ICOs, prices and platforms on which they take place. So, I recommend adding the site to your bookmarks.

Following the ICO, IEO (Initial Exchange Offering) appeared – this is also a type of crypto crowdsale, in which all responsibilities for providing the infrastructure for issuing, selling and most of the marketing fall on a centralized crypto exchange. In the ICO, this is done by the team itself.

The most profitable IEOs take place on popular exchanges such as Binance, FTX, Huobi, Kucoin, Gate and others. The exchanges themselves provide support to projects, the ability to raise a large amount of funds and guarantee listing on the very same exchange.

You can read how to register on the Binance exchange here.

Profitability of IEO platforms.

Often, to participate, you need to hold exchange tokens: BNB, FTT, HT from Huobi, and so on. You are given a certain number of tickets to participate based on how many tokens you hold. After that, the exchange announces the results and if there is a winning one among your tickets, then you get a guaranteed allocation to the project. These are often small amounts from $ 200 to $ 1000.

Binance has already run 23 IEOs on its launchpad. The average return is over X170.

The second place is taken by FTX, they rarely conduct IEOs, but they take a very long time to select for this project so that they can join their ecosystem and be as useful as possible. The average for 7 projects is almost 50x, on Huobi this figure from 13 projects is about 2600%.

IDO

Dependence on central exchanges did not appeal to crypto investors, which led to the emergence of a new IDO (Initial DEX Offering) model. It assumes the same as the ICO, but on a decentralized crypto exchange, which means that a startup does not need to create an infrastructure to sell its tokens and take care of adding them to the listings of crypto exchanges.

In order to launch IDO, projects create a whitepaper or yellow paper and submit it to DEX. The document is checked by exchange users, a special group of people or an external auditor (this is done in order to weed out obvious scams). If the project is approved, it goes to the launchpad exchanges – the platforms on which the initial token sale takes place.

Next, a pre-sale is launched, where you can buy tokens. To get into the pre-sale, users need to register in the whitelist and fill out a form to participate. However, in many launchpads, in order to participate, you need to buy and hold the token of the launchpad itself; they give lottery tickets for them. It should be borne in mind that the queue to hit in this case can be as long as in the first one.

This is then followed by a public sale on the DEX. There are several different models for conducting an auction. For example, on CoinList, the one who came first, was the first to pick it up. There are also those in which the number of tokens is divided equally depending on the share (launchpad tokens) in a special pool.

For startups, IDO is an attractive way to raise funds for development, because you don’t have to pay high fees to centralized exchanges and wait until she approves the project. The review is done by community members, and this opens the door for small projects and large-scale collaboration. IDOs also provide immediate access to liquidity and trading and help optimize user experience by providing a secure wallet and trading platform support built into a single interface. In addition, IDOs can support multiple types of wallets, thus simplifying the user experience.

The most popular and profitable IDO platforms.

Some of the most popular and lucrative IDO platforms include Seedify, BSCPad, GameFi Red Kite, and Dao Maker. Previously, PolkaStarter also showed good profit.

For each participation in the IDO, you need to hold or stake the lunchpad tokens on which the IDO itself is held. Often, the most interesting and most successful projects that raise funds choose several platforms for fundraising, which allows attracting many more investors.

Also, these projects open community pools so that participants who do not hold tokens can fill out a regular form in which they need to perform various social activities. Subscribe to twitter, cart, insert a wallet address, often this is a MetaMask wallet in various networks, but in no case insert exchange addresses – this will lead to a loss of funds, since exchanges may not support these tokens.

In general, community pools are very popular and allow users to invest small amounts and you can swing a small crypto deposit well. The main thing is to register in everything you can, and then do your own analysis, whether it is worth investing in this project or not. In other cases, it all depends on how many tokens you hold on your wallet.

HOLD

The next way to make money is HOLD. This term is commonly used to refer to crypto investors who do not sell their funds regardless of whether the price goes up or down.

HOLD can be translated as “Hold on with all your might,” which means holding crypto assets even during times of high volatility.

Hold can be compared to long-term investing. Holders do not respond to changes in the price of an asset, which helps them not to succumb to two common sentiments in the cryptocurrency market: FOMO (fear of lost profits), which can lead to buying at price peaks, and FUD (fear, uncertainty and doubt), which can lead to a low sale.

For the most active crypto advocates, HOLD is more than just long-term storage of currency. They believe that cryptocurrencies will eventually replace fiat currencies and form the backbone of all economic structures, so the fiat exchange rate of cryptocurrencies is irrelevant and funds must be kept in crypto.

Even if you are not such an ideological supporter of cryptocurrency, adhering to the HOLD strategy and not giving in to emotions will help you not only save money and nerves, but also bring income. Provided, of course, that you invest in promising projects.

Staking

Continuing the topic of long-term investment, let’s move on to staking. Staking can be compared to a bank deposit. In fact, this is a way of passive earnings, in which the user receives interest from the funds blocked on the Proof of Stake algorithm. Staking ensures the operability of such a blockchain, and holders receive interest on their contribution to the blockchain (as well as in the bank). The percentage depends on the project.

On CEX (for example, Binance or FTX), there is a simple way of staking: you send money, and after a while it is returned to you with interest. To do this, you do not need to manage private keys, make transactions or perform other actions, since staking does not occur directly (not to the validator), but through the exchanges. DEX usually offers coin staking that is tied to a specific DEX. For example, on Raydium, you can stake the RAY token.

There are also wallets in which you can independently choose which validator to entrust your funds to.

Landing page

Another way to make a passive income is a landing page. Landing page involves the temporary transfer of cryptocurrency at interest either to an exchange, which thereby increases liquidity, or to individuals. The transferred funds are blocked in the smart contract.

As an example, a landing page can also be carried out on Binance, which presents two types of it:

- Perpetual contract. Has a low interest rate, funds can be withdrawn or added at any time.

- Fixed contract. Has a certain period (for example, 10, 15, 30 days, etc.), and a higher interest rate. Funds can be withdrawn only after the expiration of the contract.

Nodes and testnets

Moving on. And let’s move on to the nodes and testnets. Recall that a network node is a server that is part of the blockchain and ensures the execution of the consensus algorithm. The nodes interact with each other to ensure the safety and health of the network. By itself, the installation of a node does not give any rewards, first of all, it is just an initiative to support the project.

Before releasing a startup into the big world, the developers check its performance in a special environment, which allows you to identify and eliminate possible shortcomings without loss, as well as check all the functions of the network. This environment is called testnet. After successfully passing the testnet, the project goes to the main network or mainnet. Participation in testnets can be a source of income. By awards, they are divided into 2 types:

- Incentivised is when a project provides a reward for participants for testing the network. The reward can be different: prizes in the leaderboard, rewarding each participant with project tokens, allocation on the sale, access to early versions of the application, etc. Often, testnet participants end up in the Maine and can expect to receive a delegation from the team. Although there are also funny rewards that barely cover the money spent on the servers. Many testnets may not even be labeled incentive, but projects can suddenly reward their testers.

- Non-Incentivised is when there are no stipulated rewards. But, by the way, sometimes it still happens.

Testnet is an opportunity to participate in promising projects at an early stage and it is possible to get any bonuses for this, gain experience, show yourself to the team and, at best, become a validator of the main network and continue to receive rewards.

It is not so easy to get into the validators for the top project, but it is quite possible. In addition, noteworthy projects are launched all the time, so there are no latecomers yet.

Testnets can be monitored here.

Airdrop

Airdrop is a free coin giveaway to early adopters. In fact, an airdrop is a marketing ploy that aims to spread information about the project, build a community, attract investors and develop infrastructure. Most often, to get free coins, you need to follow simple steps, for example, make a post on social networks about the project, subscribe to official communities, comment or carry out several operations in the ecosystem.

Bounty

Bounty programs are somewhat similar to Airdrop. No investment is required to participate in such a program. You need to complete certain tasks from the team, for which it will pay in tokens. However, this is more like a prescribed game: there are specific tasks with a fixed amount of reward. Tasks can be different, for example, searching for bugs, reposts in social. networks, writing posts, design, testing, forum moderation or translations of materials into other languages. These programs usually last for several weeks.

Ambassador and referral programs

Ambassador and referral programs are also aimed at expanding the community. In the case of an ambassador, you become, as it were, a representative of the project and interact with the audience, and are looking for the same enthusiasts as yourself. You also perform other actions that are aimed at increasing popularity. You can say that you are a marketer and you are rewarded for it. Most often, such cooperation lasts for several months, but with long-term plans, the program can work for years. Usually, in order to become a participant in an ambassador program, you need to pass a small introductory test.

A referral program is a type of cooperation in which you receive a reward for attracting new users (referrals). As a rule, both the one who brought and the one who was brought receives bonuses. It happens that projects launch one-time referral programs, for example, within the IEO or in honor of a major update.

Bounty, airdrops and ambassador programs can be found here.

P2E (Play-to-Earn)

Play-to-Earn (P2E) is a new way to make money in video games where gamers can earn cryptocurrencies and NFT tokens. In the past few months, the trend on P2E has begun to develop rapidly and attract more and more new users who are interested in making a profit. The number of games has already exceeded 200, while they occupy up to 45% of the traffic of all decentralized applications. Now this trend is singled out as a separate direction of GameFi (Game Finance).

Everything is simple here: users play a game and earn cryptocurrency or NFT. The conditions for receiving the reward vary depending on the game itself. Here, as well as with nodes, projects with top funds will most likely also reward early users.

Of course, now we see a huge flow of users in Play2Earn, but in fact it is not too late, since the story here is exactly the same as with projects from past trends. This sector is still ahead and there is now an opportunity to be an early user and get the maximum profit in the future.

Conclusion

In conclusion, I want to remind you that almost all methods of making money in a crypt are high-risk operations.

Basic tips to follow before investing in something:

- research the project itself and its team. Make sure team members have real social media pages and can be contacted. You can also check what experience they have, what other projects they took part in.

- research the technical documents and the roadmap.

- carefully consider the site of the project, how well it is made and whether there are actual or logical errors, typos. Usually, their presence indicates that the site is whipped up to divert the eyes.

- evaluate the list of investors who supported the project. There should be reliable companies among them.

- You can also check if the code has been reviewed by a third party (for example, another project that specializes in auditing). The presence of such a check indicates a thorough approach to security.

In all the methods that I have described today, you need to turn on your head and, to some extent, your imagination. Nodes, testnets, ambassador programs or banuti are not momentary riches, they are focusing on the future. Most of these methods do not even require money, only your time and skills. To participate, you do not need to buy courses or join paid groups, all instructions are freely available, you can always find specialized communities, where most likely there are answers to all questions.

Thus, you can successfully make money in the cryptocurrency world, without using the daily risky trading shenanigans, which will most likely provide you with only a nervous tick, and not profit.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

Join my telegram channel.

All cryptocurrency articles are here.

Reviews: