Many Russians are hastily converting their savings into cryptocurrencies in an attempt to avoid Western sanctions and counter-sanctions from the Russian Federation. In this article, I explore the financial soundness of the largest and oldest stablecoin Tether (USDT). Spoiler: there are serious questions for it.

Russians have sharply awakened interest in cryptocurrency in connection with the well-known events with Ukraine. At the moment, blockchain operations remain one of the few working ways to move money across borders. Even those who were previously very skeptical are now registering on crypto exchanges. People make crypto wallets and transfer their funds there as soon as possible.

I recently walked a similar path. To be honest, I don’t know much about crypto. I am not a trader, I am a holder. But I am good at finance. So in this article, I tried to analyze the most popular stablecoin from the financial side.

After reading, the answers to the questions “How likely is it that a USDT bought for $1 will suddenly become worth much less?” should become more understandable to you. “How can devaluation happen?”

Why stablecoins are needed and how they work

If you are going to transfer part of the capital into cryptocurrency, then the basic option may be to buy the largest and most famous coins like Bitcoin or Ethereum. But there is one problem: their value in terms of traditional (fiat) money behaves in a way that is difficult to predict.

For those who believe in the bright crypto future, this is more likely to be beneficial (one can hope to “make X” and get rich). Other people may not be excited about the prospect of investing $10,000 in crypto, and in a couple of months, getting only $4,000 out of it.

This problem can be solved by stablecoins, the value of which is rigidly tied to some kind of anchor. We will consider stablecoins pegged to the US dollar as the most common.

To understand how classic stablecoins work from the financial side, let’s look at a hypothetical example (so far, even without the participation of the crypt itself). Suppose someone comes to Eagle Bank LLC and deposits a million dollars into a separate account, and in return he is given one million Eagle-coins printed on a piece of paper, each of which, as it were, costs $1.

This is Eagle. Maybe it costs $1

Terms of acceptance

Three conditions must be met simultaneously for other people to be willing to accept these candy wrappers (sorry, Eagle coins) as payment for something and recognize a $1 value for them:

- Eagle coins are very difficult or impossible to counterfeit.

- It is possible to reliably ensure that Eagle Bank has sufficient reserves to fully cover the value of all Eagle Coins in circulation.

- There is a mechanism for “redemption” of these coins, which allows you to exchange them at any time at Eagle Bank at face value for the corresponding equivalent of “real” dollars.

Actually, classic stablecoins work in much the same way, only digital tokens are used instead of paper Eagle wrappers. The cunning mathematical magic of the blockchain makes it possible to reliably prevent the counterfeiting of such tokens (the first item on the list). Well, with paragraphs 2 and 3 we have to deal with below in the text.

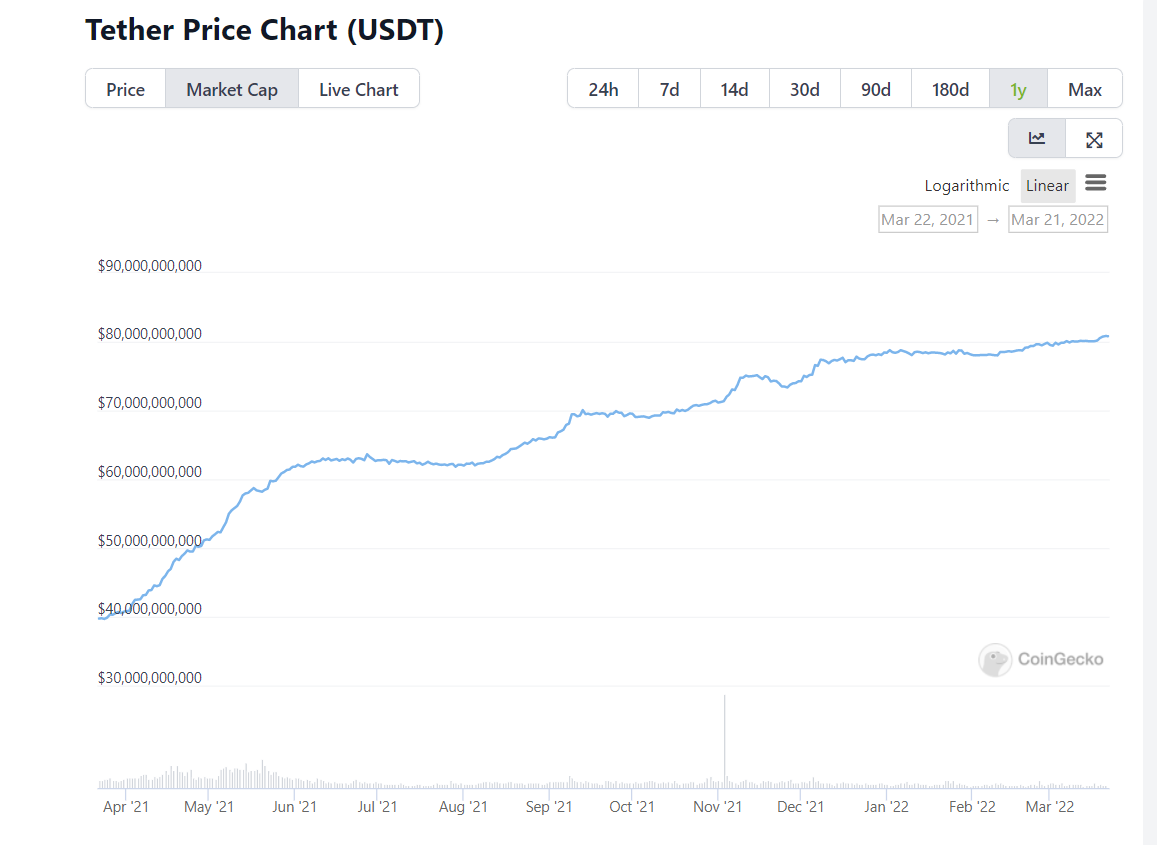

And we will do this using the example of Tether, the largest and most popular stablecoin that issued Eagle Coins (sorry, USDT) for a total amount of around $80 billion.

What is Tether (USDT) backed by

Tether is a token (often referred to as USDT) issued by Tether Limited, a company registered in Hong Kong in 2014. And it, in turn, is owned by the same guys who rule the Bitfinex crypto exchange. It is primarily known for the fact that in 2016 she was scammed and stole 120 thousand bitcoins. At the current exchange rate, that would be about $5 billion. So all the clients of the exchange forcibly reduced their deposits by about a third.

By the way, the enterprising hacker turned out to be the Russian boy Ilya Lichtenstein, who was just arrested just a couple of months ago.

Ilya Lichtenstein, his wife Heather Morgan and a crocodile (perhaps one of them knows the password to a billion-two bitcoin wallet)

Since its inception, Tether has proudly stated on its website that each issued Eagle-coin is backed by a real and live dollar, securely lying in a bank account. But in 2019, the New York prosecutor’s office concluded that this claim was not true.

Where’s the money?

In particular, it turned out that in 2018, Tether sent $625 million of its reserves to the Bitfinex exchange, which at that moment was sorely lacking money to pay off its obligations to customers. Why? Because Bitfinex, in turn, kept more than $1 billion of their clients’ money in the murky Panamanian “bank” Crypto Capital Corp. He managed to lose control over them due to problems with law enforcement in different countries.

By the way, so that you understand how financial relationships work in the new crypto world, I will quote the official conclusion of the prosecutor’s office: “no contracts or other written agreements between Bitfinex / Tether and Crypto Capital Corp. never existed.” Well, that is: the boys handed over a billion bucks to the CCC (not to be confused with MMM!) just like that, on parole. Reliability!

They were able to return the money borrowed from the reserves after Tether and Bitfinex were taken by the prosecutor’s office for a causal place. In addition, they were ordered to radically increase the transparency of disclosure of information about reserves.

Actually, this is a very important point. Real (normal) banks are required by law to publish regular and very detailed reports on where their assets are invested (which, in fact, ensure their ability to return money to depositors).

Moreover, this reporting must also be subject to mandatory audit. During which serious independent guys confirm its correctness.

Results of the audit

Since 2017, Tether has been promising to share the results of the audit (it will be ready just about, in the coming months – and maybe even earlier!), but so far it somehow does not add up. Instead, they publish quarterly “consolidated statements of reserves” with an independent accountant’s opinion. This is not at all the same as full-fledged financial statements with an auditor’s report. The disclosure standards here are much more streamlined.

In particular, these reports do not disclose in any way which banks hold Tether reserves. Decent banks in decent jurisdictions do not want to do business with this company (after all, you will not wash off scandals). So, it is likely that the money is placed in various analogues of dubious offices like Crypto Capital Corp., which have nothing to lose in terms of reputation.

Composition of Tether’s reserves

But let’s nonetheless take a look at the disclosed composition of Tether’s reserves as of the latest available date, 31.12.2021. So the $78.6 billion in reserves breaks down like this:

- 44% is placed in short-term US government bills (Treasury Bills). This is the most reliable asset, there are no questions.

- 9% is placed on bank deposits and in money market funds – in theory, this should also be quite reliable (with the proviso that we do not know what kind of banks they are and how stable they are).

- 31% in corporate bonds for up to a year – here they write that these are mainly papers with a very high reliability rating. But there are certain suspicions that there may be a bunch of Chinese bonds in the composition. And the Chinese, as we know, are often very creative in their approach to financial accounting.

- The remaining 16% is loans to some undisclosed firms, longer bonds, precious metals, and vague “other” investments (marked “including digital tokens”). The reliability of this part is very difficult to assess. Big surprises can be hidden here, judging by the vague wording.

The fact that none of the professional participants in the bond market has ever worked with them raises separate questions for financiers. Although Tether is confidently among the top ten world leaders in terms of the portfolio of short-term debt securities.

Western market bonds

It must be understood that in Western markets, bonds are not traded directly on the stock exchange, but only through large intermediaries like investment banks. How it is possible to service a portfolio of short-term securities in the amount of tens of billions of dollars in such a way that none of the professionals sees or hears this is not entirely clear.

By the way, in October 2021, the financial investigation firm Hindenburg Research announced a reward of up to a million dollars to anyone who can share previously unknown details about Tether reserves. But we don’t hear about a queue of people for the prize.

In total, about half of the Tether reserves have certain questions in terms of reliability. The scenario is not at all ruled out that if you need to urgently liquidate them, it may turn out that in fact they can be turned into a much smaller amount of money than the one for which they are accounted for on the balance sheet.

What is the point for Tether to keep its reserves in less reliable assets? It’s simple: you can put the $ 80 billion brought in the beak of crypto enthusiasts into the ultra-reliable short US government debt, and earn about 0.1% per annum on this. And you can give this money to some troubled Chinese, and earn 1% per annum on them.

Still, $800 million in revenue per year is much nicer (about 10 times) than $80 million. Well, reliability is not so critical here. In the end, if one of the Chinese does not give back the money, then this is not their own to lose, but someone else’s!

Arbitrage Mechanism: How Tether’s Value is Pegged to the Dollar

Let’s finally look at the final condition for a strong $1 stablecoin pegging: the possibility of arbitrage. Since Tether is traded on crypto exchanges, its value will be determined primarily by the balance of supply and demand. Indeed, USDT is sometimes traded not at $1, but in the range of $0.99-1.01 or even wider).

In order for the price of the token not to go far from $1 due to intermittent imbalances in supply and demand, there must be some kind of arbitrage mechanism that will push it back to $1.

For Tether, this arbitrage mechanism is to allow market participants to convert 1 USDT into $1 and vice versa. For example, if on an exchange 1 USDT suddenly drops to $0.99, then an arbitrageur can buy it at this “low” price and redeem it directly in Tether for $1, earning a quick risk-free return of 1% ($0.01).

And vice versa: if the market is ready to “eat” USDT at $1.01, you can create new tokens directly in Tether for $1 and sell them on the exchange at a higher price. (All this adjusted for the fact that the minimum amount to create / redeem USDT directly in Tether is $100,000.)

This mechanism functions quite effectively, so we do not see significant price fluctuations of USDT around $1. This mechanism works quite effectively. Although attempts to redeem USDT directly with Tether from my trader friend and his friends were unsuccessful. Most likely due to some “problems with the processing of bank transfers” on the side of Tether.

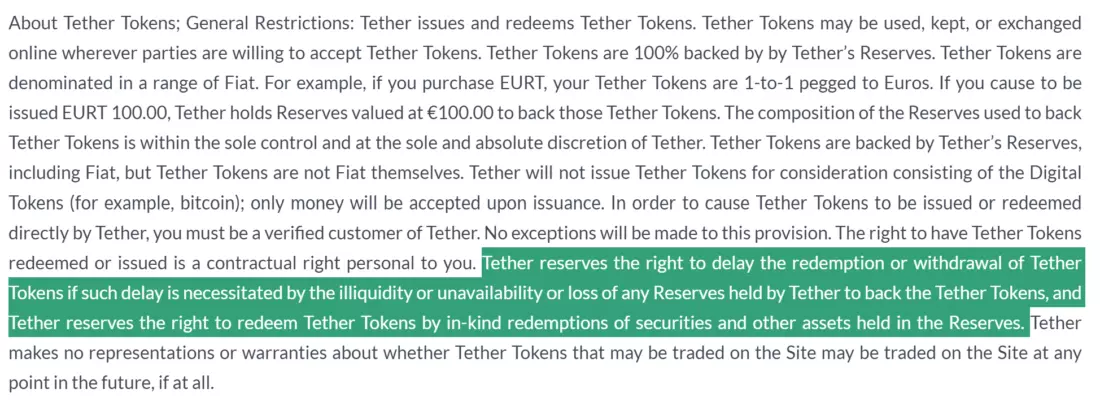

Tether (USDT) buyback obligations

It will not be superfluous to pay attention to the fact that Tether does not mention anywhere on its website that there are any firm obligations on their part to redeem USDT and exchange it for dollars of their reserves. At best, the loose language suggests that a limited subset of “verified Tether customers” are eligible for redemption. But if desired, it can be frozen at any time until better times.

TLDR from the Tether website: the right to exchange USDT for the dollar is exactly until the moment when it does not exist.

What the collapse of Tether (USDT) might look like

By now, you might have already guessed that I am quite skeptical about the reliability of Tether. This does not mean that the collapse of the USDT is inevitable. But there are risks of negative developments.

This stablecoin may well feel great for many years to come. Especially, while the active phase of the growth of interest in blockchain and DeFi spurs an increase in demand for USDT and leads to a steady increase in the number of tokens in circulation.

CoinGecko: Tether (USDT) Capitalization Growth

But let’s still consider how exactly the scenario for the collapse of Tether could look like. Especially since some hedge funds are already betting heavily that this event could happen within the next 12 months.

Suppose, at some point, another negative news about Tether appears in the style of “20% of the company’s reserves were frozen in a Panamanian bank, which is under investigation for money laundering.”

Frozen is not yet confiscated. However, the crypto community is still starting to worry. The most nervous USDT holders decide, just in case, to exchange them for a slightly more reliable-looking USDC stablecoin (we will analyze it in the next article), since these tokens already have more than $50 billion in circulation.

Demand for USDT is falling sharply, while supply, on the contrary, is growing. USDT stock quotes are temporarily sliding from $1 to $0.9. This, in turn, provokes arbitrageurs to buy cheaper tokens and redeem them directly in Tether for a dollar. And everything works great: the price really stabilizes!

Tether (USDT) reserve report

True, the following report on Tether reserves shows that all repayments were made using cash on hand and the sale of ultra-secure US government bills. So, with USDT’s overall plummeting capitalization, most of the remaining reserves are now obscure “loans to third parties” and “very safe debt securities, but we won’t say whose.”

People are beginning to understand that if the USDT redemption continues at this rate, then soon all the good assets in the reserves will be sold off. And the remaining token holders will be left face to face with the most trashy assets, the reliability of which is no longer very desirable. There is a situation “who was the first in time, that and well done.” So all USDT holders are rushing into Tether at the same time, in an attempt to get a dollar for them, while they are still giving.

When the USDT capitalization is about halved, Tether suddenly stops exchanging tokens for dollars. First, in private communication with clients, they write about temporary difficulties with the transfer of large amounts of funds between banks.

Tether (USDT) and fiat

Then, when especially stubborn journalists get involved, a spokesman for Tether makes a statement. “As we have repeatedly emphasized in the past, Tether has never guaranteed or undertook an irrevocable obligation to convert unlimited amounts of USDT into fiat currency.”

At some point, financial regulators are already involved in the case and forcibly begin the bankruptcy procedure of the company. During the inventory of the existing property, it is discovered that tens of billions were lent to the company “We Can Mine Ltd.” It is not possible to contact her to claim the amount, five billion is listed for reserves in cryptocurrency. Private keys to the corresponding wallets cannot be found. And another 20 billion invested in the debt obligations of a couple of Chinese giants in the real estate industry, which, due to the current difficult economic situation, are traded on the market at about 70% of the face value.

By this moment, in shock, the owners of Eagle Coins are left with a difficult choice: either sell them on the exchange right now at the current price of about 50% of the face value, or try to wait for the end of the bankruptcy procedure and the division of Tether property between creditors, in the hope that after all legal proceedings are over get a little more in a few years. The end!

Of course, the story above belongs solely to my imagination, but in reality everything can happen completely differently. This is just one of the options for the development of events. It must be understood that maintaining the status quo is much more profitable for Tether owners. It is better to be respected pioneers of the crypto industry and cut 1% of $80 billion annually than to steal 20% of the same amount and be universally hated crooks. But, nevertheless, the transition from the first scenario to the second, if desired, can happen very quickly.

Conclusion

If you are going to transfer a significant amount for you to Tether, then I recommend that you think about whether you would put money on a deposit in the conditional Eagle Bank, about which the following is known:

- The bank’s chief financial officer is a former plastic surgeon.

- The bank has been caught lying about where it invests its assets in the past and has been repeatedly fined tens of millions of dollars by prosecutors and financial regulators for doing so.

- The bank’s equity capital is only 0.2% of assets – at least an order of magnitude less than the minimum required capital for real European banks.

- The bank does not issue full-fledged financial statements, no one audits it and, in fact, does not control its activities.

- It is not known what specific assets the bank’s reserves are invested in. Аnd there is no information about who is their holder (but it is known that in the past the bank placed reserves in third-rate financial institutions without any documentation of its relationship with them).

- The bank, in very streamlined terms, writes in small print on its website that it is not ready to assume any obligations and give any guarantees regarding the return of funds invested in it.

- The bank’s managers also have another investment business, which at one time, due to a leaky security system, became the victim of one of the largest hacker attacks, which led to the loss of a third of their capital by its clients.

Of course, Tether is not a bank, and comparing them directly is not always correct. But personally, all of the above is enough for me to draw a conclusion about the reliability of investing in USDT.

The following articles will be devoted to the analysis of other popular stablecoins (USDC, BUSD, DAI, UST) – if you don’t want to miss it, subscribe to my Telegram channel. There I try to find reasonable approaches to personal finance and investments.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

All crypto articles are here.

Reviews: