Bitcoin is the first cryptocurrency to appear back in 2009. Today it is the largest cryptocurrency in terms of capitalization, the value of which is steadily growing. Large companies and private investors invest in Bitcoin. Its algorithm is created in such a way that there can be no more than 21 million coins in total, of which some bitcoins (BTC) are irretrievably lost.

In this article I will tell you:

- how it all started with bitcoin

- how the bitcoin blockchain works

- Bitcoin – money or store of value?

- what determines the price of bitcoin

- the value of bitcoin, what is it?

How it all began

Technologists first learned about cryptocurrencies in 1999, when one of the users of the Reddit website discovered a post about electronic money in the mailing list. It is assumed that the author may have been Satoshi Nakamoto himself. This user wrote that transactions in digital money must be irreversible and must exclude the possibility of double spending. As a solution to this problem, the user suggested creating a public database. Then the blockchain concept was proposed.

The history of bitcoin began on January 3, 2009, when Satoshi Nakamoto finished developing the Bitcoin program code, created the first block in the currency blockchain and mined the first 50 bitcoins (BTC).

How the Bitcoin blockchain works

Bitcoin blockchain solves the problem of double spending. Double spending is the re-sending of funds, which is theoretically possible in electronic money. With regard to cryptocurrencies, double spending is the repeated sending of the same amount to two different addresses. There is no such thing in Bitcoin, and here’s why.

Blockchain is a distributed ledger of data. Each transaction is written to a block in chronological order, and each block is placed at the end of the chain. Blocks are created and decrypted by miners. It is a special users of the Bitcoin network who compete for the right to mine a new block, because they receive a reward for each new block. After the block is decrypted, the miner who created the block provides it to other miners. They check it and, after checking, put it at the end of the chain. So the blockchain “grows” by 1 block, and the new state of the blockchain is copied to all computers involved in BTC mining. Thus, the actual copy of the blockchain is permanently kept by the miners. To hack the network, you need to hack all the computers of the miners, which is almost impossible.

Since transactions are chained in chronological order, double spending is only possible if transactions are processed selectively, i.e. include the later transaction in the block, and ignore the first. Such a situation is extremely unlikely, because it is possible only with the collusion of miners. Miners, on the other hand, compete for blocks and strive to include all transactions in a block in order to be the first to decrypt the block and receive a reward in the form of bitcoins (BTC) for it.

To decrypt a block, the miner selects a unique number (hash) that must meet the specified conditions. This is done by the brute force method, i.e. just selection. This takes all the computing power of the miners, for which they receive a reward. And such an algorithm for creating blocks is called PoW (Proof-of-Work – proof of work). After finding the desired hash, the block is transferred to other miners, who confirm it and place it at the end of the chain. The time to create one block is 10 minutes.

Bitcoin: money or store of value?

Despite the fact that bitcoin is called a currency (“the first cryptocurrency”), while it weakly performs the function of money. In almost all countries, settlements in bitcoins are prohibited, except for the United States and El Salvador and some others. But even there, you can pay with bitcoins only in some companies for goods, for example, Tesla. In the overwhelming majority of countries, bitcoin is prohibited as a means of payment, and in some cryptocurrencies are prohibited in principle.

However, here you can recall the well-known case of buying two pizzas for 10 thousand BTC. On May 22, 2010, a US programmer ordered two pizzas, spending 10 thousand bitcoins on them. Since then, the cryptocurrency community has celebrated “Pizza Day” on May 22, and this programmer (he was Laszlo Heinitz) is considered the most famous “failed millionaire”, because now his 10 thousand BTC would be worth over half a billion dollars.

On cryptocurrency exchanges, bitcoins are traded, and people buy / sell bitcoin, investing money in it. From November 2020 to November 2021, the first cryptocurrency rose in price by 200% – from $ 18,800 to $ 57 thousand, and it seems that it is not going to stop there. In the current situation, Bitcoin is more like gold or another asset with a limited supply than a currency in the traditional sense.

What determines the price of bitcoin (BTC)

From 2009 to the present, the value of one bitcoin coin has come a long way, rising from hundredths of a dollar to almost 70 thousand dollars. The price is influenced by the general acceptance of cryptocurrencies in society, because Bitcoin is considered the first and main cryptocurrency. For many people, the entire cryptosphere is associated primarily with bitcoin, which makes it a recognizable and desirable asset. In general, it is the price of bitcoin that determines the mood in society and among investors towards cryptoassets.

The number of bitcoins ever mined will be 21 million, and there will be no more. This makes Bitcoin a deflationary asset, i.e. such a currency that will only rise in price. In addition, there is another trend that only gets stronger over time; this is a decrease in the rate of growth of bitcoin as a result of halvings and the accumulation of BTC on wallets. Long-term investors do not spend bitcoin, but put it in their wallets and store it, while every 4 years the rate of growth in the mass of bitcoins decreases. This leads to a shortage of bitcoins and, as a result, to an increase in its price.

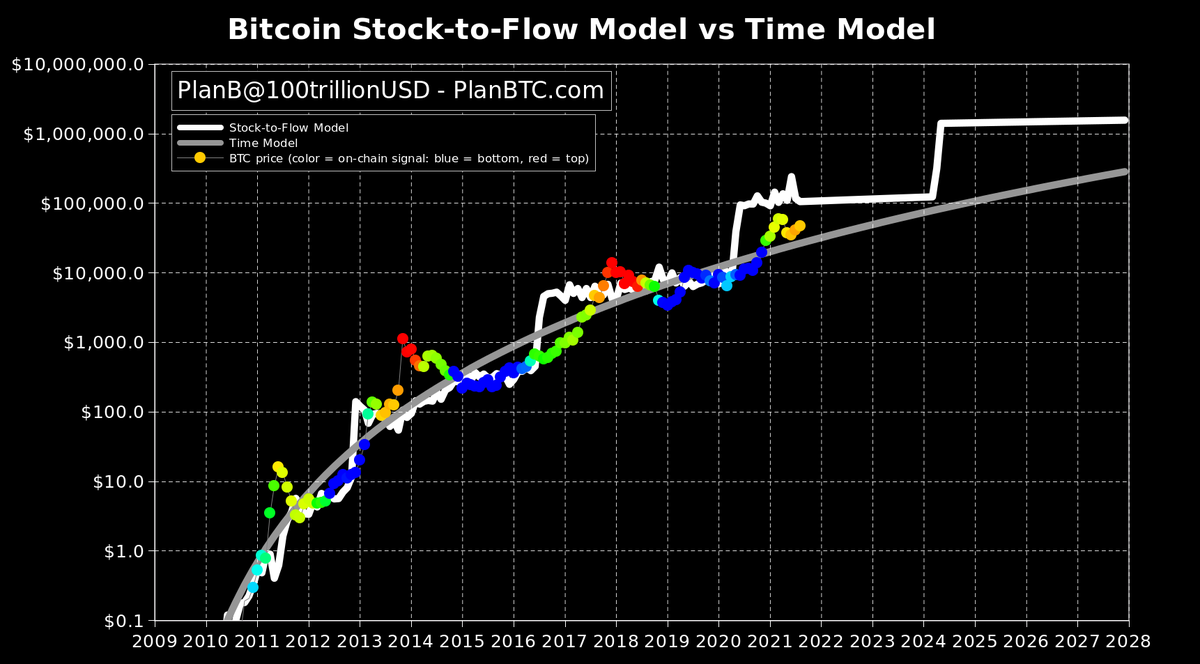

The network has a widely popular BTC pricing model from analyst PlanB, which he calls S2F, Stock-to-Flow. He compiled a growth model for the price of bitcoin and displayed it on a chart.

In this chart, the ordinate is not a linear price scale, but a logarithmic one. This means that each division along this axis means a multiplier in the form of a power of 10 in the bitcoin price: $1 is 10-1, $10 is 101, $100 is 102, etc. Colored dots represent the real price of bitcoin at a historical moment. White dots at the bottom – the ratio of the real bitcoin price to that predicted by the S2F model (the closer to 1, the more accurate the S2F model). The white line is the Stock-to-Flow model itself. PlanB bases its predictions precisely on halvings and the fact that over time, the growth rate of new BTC will fall, and the number of coins on wallets that are not spent and just lie will grow.

We can see that overall, historically, the price of BTC has followed the predicted S2F pattern. If the dependence continues further, the milestone of $ 100 thousand awaits us in late 2021 – early 2022, and a million dollars per coin already in 2025. Well, wait and see.

Bitcoin value (BTC)

For all the similarity between bitcoin and gold, there are significant differences between the first cryptocurrency and the noble metal, and all of them play into the hands of bitcoin, leaving no chance for gold.

First, hundreds and thousands of tons of gold are mined every year. Of course, its reserves in the earth’s crust are not endless, but so far there is no limit in gold mining. Bitcoin will be mined in the amount of no more than 21 million coins, which makes it an absolutely deflationary asset (and this is one of the factors why BTC will not become money in the usual sense). With the world’s central banks turned on the money machines at full capacity, any deflationary asset is doomed to growth. According to some analysts, due to the rarity of bitcoin, in the future there will be less than 0.01 BTC for every inhabitant of the Earth. Due to the continuous growth of the price (possibly up to several million dollars), even this amount will be quite large.

Secondly, Bitcoin is much more convenient to store than gold. One smartphone is enough to transfer and store any amount in BTC, while guarded warehouses and storages are needed to store gold in the same equivalent.

Thirdly, operations with bitcoin are much easier than with gold. Transferring many millions of dollars in bitcoin requires pressing a few buttons on a computer, while transferring gold bars will require the creation of an entire supply chain involving dozens of people.

Conclusion

Bitcoin is the “locomotive” of the entire cryptoindustry and an extremely interesting phenomenon of modern life. They look at it, orient themselves at it, take it into account when evaluating market crypto cycles. It is largely thanks to bitcoin that the entire cryptosphere is developing with its many projects and cryptocurrencies.

In view of its qualities, BTC will definitely grow, and in the future, the price will grow tenfold. But we must not forget about crypto cycles: strong rallies will inevitably be followed by corrections, and you need to be patient to see big money in your account.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

For a quick communication with me, write to the telegram.

All crypto articles are here.

Reviews: