Stablecoins are a cryptocurrency pegged to a fiat currency at a ratio of 1:1.

They are trying to combine the best of cryptocurrencies and fiat money. From the first – decentralization and anonymity, from the second – stability. Consider in detail all the pros and cons of these cryptocurrencies.

What is a stablecoin?

It is a cryptocurrency pegged (usually, but not always) to a fiat currency at a 1:1 ratio.

All cryptocurrencies today are characterized by high volatility. But as planned by the creators of the stablecoin, it is tied to a stable fiat currency. It must be stable, unlike other crypto coins.

Thus, they are trying to combine the best of cryptocurrencies and fiat money. From the first – decentralization and anonymity, from the second – stability.

In fact, a stablecoin can be pegged to any asset, not just fiat money. It can be gold, silver, oil, and even the value of some securities. Therefore, the number of stablecoins is only increasing. So, there is a stablecoin CACHE gold tied to the value of gold.

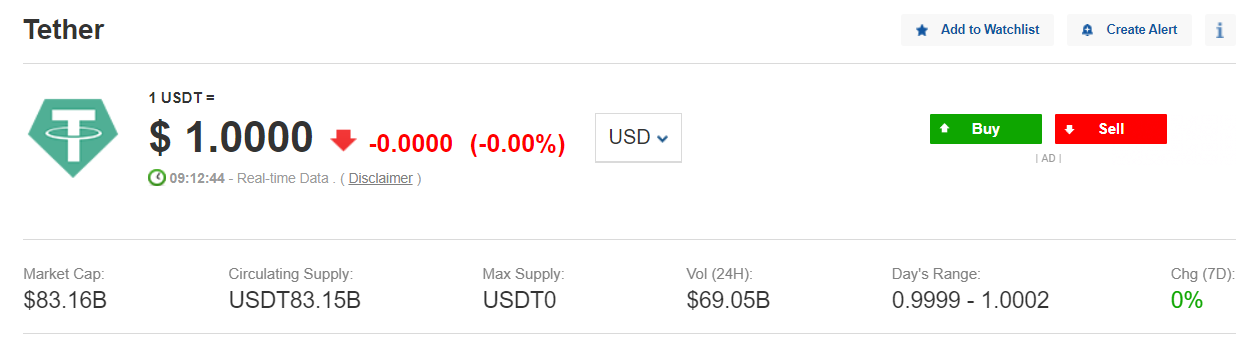

The popularity of stablecoins has also been on the rise lately. The market capitalization of the most popular stablecoin Tether by April 2022 exceeded $82 billion.

What is a stablecoin for?

As a rule, it is used to buy other cryptocurrencies on crypto exchanges. First, fiat money is converted into stablecoins, and then they buy the desired cryptocurrency.

Stablecoins are convenient if the cryptocurrency needs to be transferred from one exchange to another, for use in DeFi services, as well as for the so-called “yield farming”. These are cryptocurrency placements on DeFi lending platforms.

Stablecoins also fell in love with large companies. For example, Visa allows crypto transactions through the USD Coin.

How stablecoin work

The main difference in how it work is how their value is maintained. Some stablecoins, such as Tether, use a custodian for this. It regulates the work of the virtual currency and keeps the necessary reserve of security funds.

If the stablecoin is backed by dollars, then those dollars are held in a real bank account. This is how Binance USD, owned by the Binance crypto exchange, works. The collateral in this case is held in Paxos bank accounts.

Other stablecoins can use smart contracts for this purpose.

Types of stablecoins

There are three types: backed by fiat money, cryptocurrency, and not backed by anything, or algorithmic stablecoins.

Fiat stablecoins are the most popular option, the value of which can be backed by fiat currency, gold, silver, and so on.

These stablecoins include Tether, USD Coin, TrueUSD, PAX Circle, and others.

Other recent additions include central bank digital currencies (CBDCs) and corporate stablecoins such as Diem. It was invented, but has not yet been launched, Facebook.

Cryptocurrency stablecoins, as you might guess, are backed by another cryptocurrency, and their value can be tied, for example, to the dollar. Since the crypto is volatile, a larger amount of cryptocurrency is used to issue a smaller number of such stablecoins. Let’s say that $2,000 worth of Ethereum tokens become a reserve for issuing stablecoins equivalent to $1,000.

Thus, the stablecoin, up to a certain level, is insured against the volatility of the ether.

It would seem, why tie the value of a cryptocurrency to a volatile cryptocurrency, if the meaning of a stablecoin is precisely in the absence of price fluctuations? But some people do not like that fiat stablecoins are too centralized, like a regular currency.

Cryptocurrency stablecoins include MakerDAO, Havven, and others.

Algorithmic stablecoins are not backed by any assets, but rely on an algorithm to maintain exchange rate stability (this mechanism is somewhat similar to the work of a central bank to support a currency).

For example, depending on the market situation, the algorithm can increase or decrease the emission of a stablecoin.

Examples are DefiDollar and Ampleforth.

Pros of stablecoins

- As with other cryptocurrencies, stablecoin transactions are anonymous and secure;

- In the case of fiat stablecoins, you also get a stable cryptocurrency without sharp price fluctuations.

Cons of stablecoins

- It will not work to make money on the course;

- Proponents of decentralization will not be happy with the fact that the operation of the stablecoin is provided by a third party;

- When investing in a stablecoin, you must be sure that its value is really backed by something. Even the most popular Tether could not prove that 100% of the coins are backed by cash.

FAQ

What are stablecoins and what are they for?

This is a cryptocurrency, most often pegged to the fiat currency rate in a ratio of 1:1. It is mainly bought to purchase other cryptocurrencies on crypto exchanges – first, fiat money is converted into stablecoins, and then the desired cryptocurrency is bought with them. It is also convenient to use stablecoins to transfer cryptocurrencies from one exchange to another.

What are the pros and cons?

Transactions are anonymous and secure, and are not subject to rate fluctuations – this is a plus. The downside is that for the same reason, you won’t be able to make money on the course. In addition, for example Tether, USD Coin, TrueUSD, PAX Circle are backed by real financial assets, that is, they are not decentralized.

Disclaimer: This article is not investment advice. Assess the risks yourself before making any investment decisions.

Join my telegram channel.

All crypto articles are here.

Reviews: